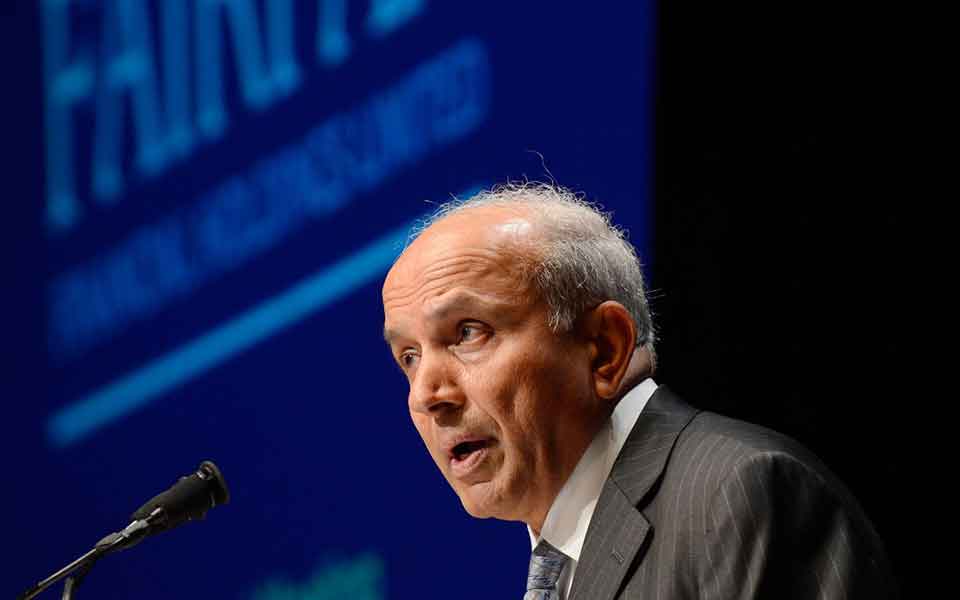

Watsa: End capital controls, open up

Greece requires economic liberalization, stressed Prem Watsa, the head of the Fairfax group, while addressing the “Dialogue2” event organized by the Eurolife ERB Insurance Group in Athens on Tuesday.

“When a country is friendly to entrepreneurship, it can work miracles,” Watsa said, reminding his audience that entrepreneurship cannot work in an environment of capital controls: “If they are abolished, then funds will start flowing into the country.”

Responding to questions from representatives of the political and business world, delivered by Eurolife chief executive Alexandros Sarrigeorgiou, Watsa referred to the significance of the European Central Bank’s quantitative easing (QE) program. Joining QE, he said, should be a priority aimed at bringing down both the country’s borrowing costs and interest rates.

“Greece’s problem is that it does not have access to the markets and when its bond issues mature it cannot return to the bond markets to refinance its borrowing,” said the Fairfax frontman. “When this changes you will be masters of your own fate once again,” said the investor who has acquired Eurolife and invested in Eurobank, Grivalia Properties, the Mytilineos Group and Praktiker.