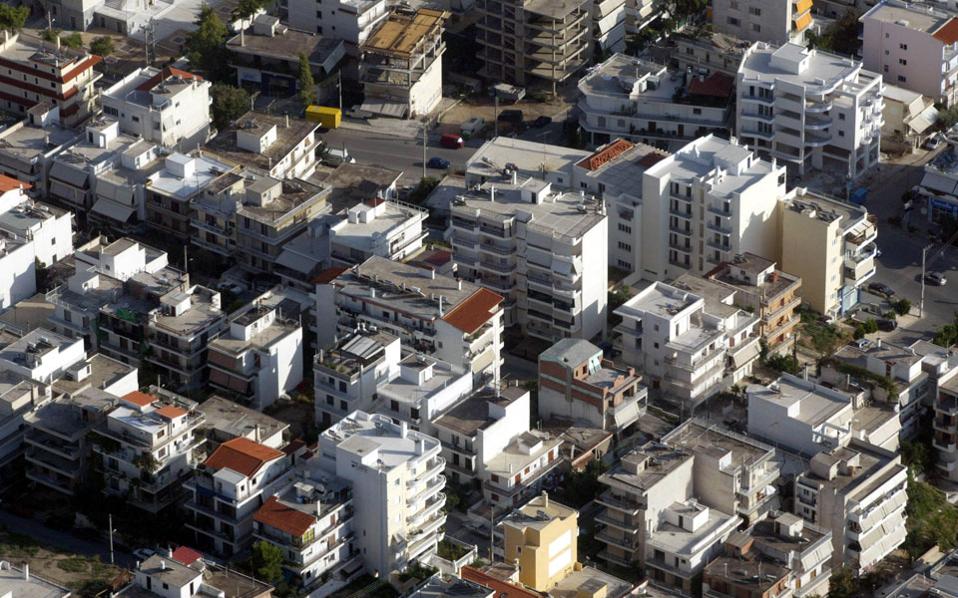

Recovery in property prices gains traction as economy improves

A nascent recovery in Greece’s residential property market picked up pace in the second quarter of 2018, central bank data showed on Thursday, raising prospects the improving economy will buoy prices further.

Property accounts for a large chunk of household wealth in Greece, which has one of the highest home ownership rates in Europe at 80 percent versus an EU average of 70 percent, according to the European Mortgage Federation.

Prices of the apartments in which most Greeks live rose 0.8 percent in the quarter from a year earlier, Bank of Greece data showed, with the recovery accelerating from an upwardly revised 0.1 percent increase in the first three months of the year.

Prices had slid 1.0 percent in 2017 from a year earlier, taking the cumulative fall since 2008, when the country’s protracted recession began, to 42 percent.

The market has been hit by property taxes imposed to plug budget deficits, tight bank lending and a jobless rate still hovering around 20 percent, the highest in the euro zone.

Apart from undercutting household wealth, the fall in property prices also affected collateral values on banks’ outstanding real estate loans. Yet values have begun to rebound in the first two quarters of 2018 and economists expect the price recovery to continue.

“The data confirm that the property market has entered a mild recovery phase,” said National Bank economist Nikos Magginas. “The recovery could gain speed if disposable household incomes and bank lending improve down the line.”

Magginas said the rebound in residential property prices was more pronounced in tourism-related segments of the market, driven by strong demand.

Greece’s economy expanded for a fifth straight quarter in the period through March this year, and at a faster pace than in the previous quarter, helped by stronger exports. [Reuters]