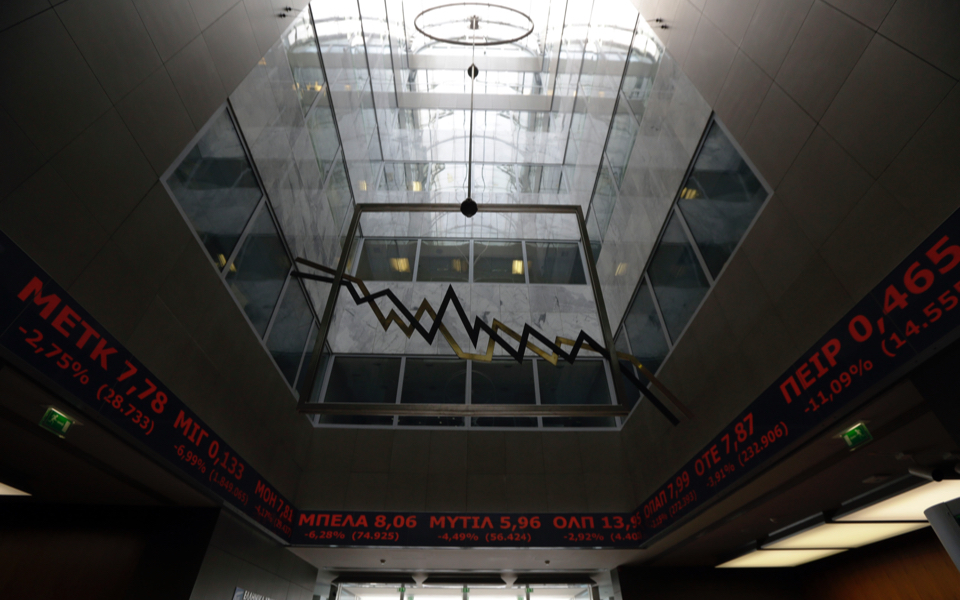

Foreign investors concerned about growth rate, Greek stocks

Institutional investors who attended 13th Annual Greek Roadshow in London last week appeared concerned at the prospects of the Greek economy and the current picture of the Greek stock market.

They told representatives of local lenders that growth must be bolstered and stagnation left behind so that banks can start issuing loans again and their revenues from interest payments improve, which would lead to a recovery in earnings. Analysts say banks’ failure to display dynamic progress constitutes a significant obstacle blocking the recovery of both the stock market and the credit sector.

Greece urgently needs measures to restore sustainable economic growth, ING warned in a recent report. However, the prospects are not bright, with Deutsche Bank noting that the chances of a positive surprise in the recovery of the Greek economy appear very slim due to the lack of any strong credit or fiscal push, despite the country’s exit from the third bailout program.

An investment bank official who participated in the recent roadshow told Kathimerini that the current picture of the Greek bourse is disappointing, with the banking sector showing a significant decline and dragging the market – already having sustained a big blow over the case of Folli Follie – to ever lower levels.

Foreign investors clearly consider that select non-credit stocks with robust fundamental figures and proper corporate governance structures are best positioned for taking part in a possible recovery of the Greek economy. Still, as long as the emerging markets landscape appears unclear, and questions continue over whether Greek is committed to focusing on its fiscal targets – especially with the discussions on averting the new pension cuts (in an effort to win votes in the next elections), which are harming the market – it seems most unlikely that buyers will returns.

Positive change might be spurred by an end to the uncertainty over pensions, the introduction of full transparency and a new era at Folli Follie, an improvement in the emerging markets investment climate and a fixed date for the next general election, with the market keen to see a strong majority for a truly pro-European and reform-minded government, which would serve as an incentive for new foreign investments, as well as strengthening the economic growth rate.