Twenty years on, what is euro’s future?

The euro turned 20 years old on January 1, 2019. On January 1, 1999, after years of preparations, 11 member-states of the European Union agreed to use the same currency in all monetary transactions among themselves, an initiative that marked the official launch of the euro. The euro’s introduction in physical form, as coins and banknotes, however, took place on January 1, 2002. The euro was broadly accepted as a unifying institution and another eight members joined the club in the years that followed.

Greece entered the Exchange Rate Mechanism (ERM) on March 14, 1998, and the Economic and Monetary Union (EMU) on January 1, 2001. Those opposed to the decision to join the euro area argued that Greece would no longer be able to control its fiscal policy. But Greece was not, and is not, like Sweden and Denmark, which did not adopt the euro. It was not a country with a stable currency and a stable economy. With a persistent trade deficit, a shortage of natural resources – oil in particular – massive debt and constant borrowing, Greece was already wholly dependent on international economic developments. Successive devaluations of the drachma, the difficulty of borrowing and high interest rates are proof enough of this – and all signs of weakness.

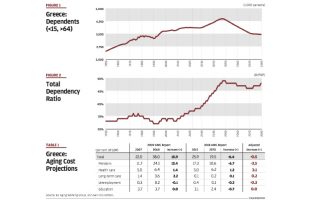

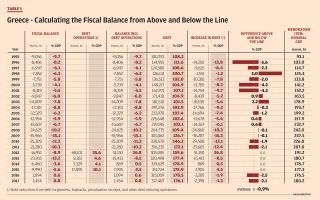

Despite efforts to stabilize the economy, Greece’s public debt today is more than 175 percent of gross domestic product (GDP) – a European record.

Greece’s induction into the EMU had a marked effect on the interest it paid on loans, slashing it dramatically. Among other advantages, this helped us save significant amounts. During the 1990s Greece spent about a third of its tax revenues on interest payments; by the end of 2003, this had fallen to less than a quarter of revenues, giving Greece much more scope to invest in education, health and welfare.

In the 20 years since the euro was first introduced, the EMU has faced significant challenges. The 2008 economic crisis, for example, resulted in Greece, Portugal, Ireland and Cyprus finding themselves unable to abide by the rules, forcing the EMU to take action so that these states would be able to meet their commitments as members of the euro area. This process resulted in mechanisms that safeguard the operation of the system. The European Stability Mechanism (ESM) is one example.

However, the 2008 crisis, which lasted about four years, gave rise to skepticism regarding the merits of the euro. Even in advanced European countries like Italy we hear the argument that the euro is the cause of their economic woes. Populist parties maintain that it ties governments’ hands to such a degree that they cannot implement the necessary reforms. In Greece, the SYRIZA-Independent Greeks coalition saw the euro as the cause of the Greek crisis and supported the country’s departure from the currency bloc in early 2015. As we know, it executed a neat 180-degree turn and adopted the rules of the eurozone.

Such negative views of the euro are not shared by the majority of European citizens, however. Public opinion polls carried out by the European Commission show that most citizens believe in European cooperation and the benefits of the euro.

But let us put Europe aside for now and remember what life was like in Greece before the euro – the problems of travel, of studying abroad and particularly of carrying out any transactions in foreign countries, or the fact that the term foreign exchange meant measures, permits, hard work and red tape. We were reminded of those days recently by the capital controls that put a cap on deposit withdrawals and added strings to all money transfers abroad. Let us also cast our minds back to the turbulence caused by the devaluations of the drachma in 1983, 1985 and 2001. Greece never had a currency that was as stable as the euro.

The euro also created some big problems, of course. Most recently, for example, we have seen popular reaction to fiscal stability measures in France from the Gilets Jaunes movement. Then there is the fact that not all member-states grow at the same rate. Germany increased the distance separating it from others by increasing its GDP faster, on the back of superior industrial output and exports.

In an article on the euro’s 20th anniversary, French newspaper Le Monde spoke of a “fragile” currency. Italy, meanwhile, is having trouble sticking to the rule that its budget deficit cannot surpass 3 percent of GDP. Spain, Portugal and Greece, which experienced different levels of crisis, have not yet returned to a smooth and stable growth path. Among the crisis countries, only Ireland has succeeded in normalizing its economy.

The economy of each country has certainly played a part, but it is not the only factor. In the 2003-05 period under Gerhard Schroeder, Germany implemented strict measures for reducing public spending and labor costs, as well as for stabilizing the economy under the Agenda 2010 initiative. Other countries – and Greece is foremost among them – disregarded the course of their economy. Greek governments ignored the rules and increased their spending beyond acceptable limits. In 2009, because of policies implemented by the New Democracy government at the time, the budget deficit reached 15.4 percent of GDP.

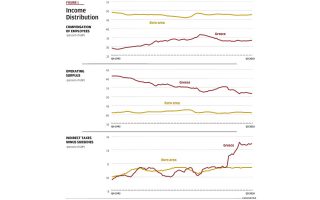

The cause and result of these developments was the fact that the EMU has been unable to effectively deal with the problem of growth disparity in Europe. The common currency does not suffice on its own to ensure that all member-states have equal opportunity to enjoy the opportunities and possibilities it offers. The current conditions favor the economic dominance of the most powerful, with the weaker members slipping ever further behind, especially if under an incompetent government.

The EMU will continue to work toward improving its efficacy, and a banking union is seen on the horizon. Yet there appears to be some hesitation over the much-needed steps ahead. The December 2018 Eurogroup summit, for example, limited itself to a statement about the need for new and powerful mechanisms for preventing and managing economic crises, as well as for the “significant strengthening” of the monetary union.

European unification without a common currency is not possible in the age of globalization and the euro has already proven itself to be the most powerful tool of unification we have. What is at issue, instead, is a new modus operandi for the Union. There are no easy answers.

There are two main issues that need to be addressed. The first – which has been the subject of extensive discussions and proposals – concerns the way the EMU is governed. The title used to describe this is “economic governance.”

The second concerns how we deal with the union’s structural imbalances so that it can work to the greater benefit of the weaker members by distributing prosperity more equally among its different areas. This does not have a title and has not generated such widespread interest as the first issue, but it could, perhaps, be described as “induction and participation.”

The European Union is neither a club where only the elites have a say, nor a federation of states that operate on the orders of a central, supreme authority. It is a joint project aimed at promoting freedom, growth and adaptation to a changing international environment.

* Costas Simitis was prime minister of Greece in 1996-2004.