An idea for incentive-compatible debt relief

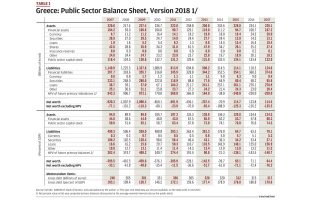

In previous Notes for Discussion, we have looked at a long-term plan to bring the debt down; issues in state enterprises and whether these might be best managed in the private sector or by public sector managers; and the public sector balance sheet, which should reflect all the debt but also all the assets that the government owns.

It was recognized that the debt ratio is too high for Greece and that it will take a long time to bring this down – a gradual plan is called for. We also mentioned that opportunistic ideas might help to bring the debt down without further increasing the primary surplus. This Note is about one such idea.

In the summer of 2018, a large number of economists (Jeromin Zettelmeyer et al) combined forces in a Policy Brief from the Peterson Institute for International Economics – “How to Solve the Greek Debt Problem” – to propose an incentive structure for Greece for conditional debt relief. The plan proposes official debt relief structured in a way that depends on additional primary fiscal adjustment beyond what is currently being contemplated by Greece and eurozone institutions and partner countries.

The amount of face value debt relief required, the paper notes, could be modest – on the order of 10 to 15 percent of the outstanding official debt. This suggests a reduction in the face value of the debt of 25-35 billion euros.

The Odysseus Plan sketched in an earlier Note does not require debt relief, but this plan takes a long time to implement; it does call for a strong primary surplus for an extended period of time, and there will of course be risks along the way. So, any further thoughts that can reduce these risks and get the debt reduction job done earlier merits consideration. The above-mentioned paper is one variation on this theme. Here is a second option that might be contemplated.

The paper by Zettelmeyer et al puts its finger on a tender point, namely that debt relief needs to be conditional. That means that Greece needs to do something to get further debt relief. Conditional debt relief is designed in part to avoid moral hazard, which means that if debt were to be forgiven without any counterpart, then there would be no penalty for countries that accumulate debt and later simply default on it, when this debt becomes inconvenient. Thus, it would provide incentives for unbridled debt accumulation. Therefore, the search is on for a form of debt relief that is “conditional” and “incentive-compatible.” Both the debtor (Greece) and the creditor (partner countries) need to get some benefit from the debt relief for this process to be acceptable to all parties involved.

With this in mind, let us recall that Greece is involved in a privatization program of state assets. These can be state-owned enterprises, real estate, or other assets that can be sold in the market and that are owned by the public sector. Thus, we have to look at the balance sheet to see how many assets the Greek public sector owns and which ones may be marketable and can be sold. If this can be done, then Greece can reduce the amount of assets that it holds on the balance sheet, and with the proceeds buy back debt, i.e. lower the debt.

This process is sometimes called “balance sheet shortening,” because it involves lowering both assets and liabilities at the same time. (During its crisis decade in the 1980s, the Netherlands used significant balance sheet shortening to lower the stock of debt.) If the assets provide a poor rate of return and the debt is expensive and/or gives rise to concerns about debt servicing abilities, then a balance sheet shortening operation can be a valuable financial mechanism to bring the public finances into better shape.

This is done in many countries, and indeed in many private companies, in one form or another, as the need arises. Balance sheet shortening does not require further measures to increase the primary surplus targets.

Now, Greece has complained that it is not a good idea to try and sell state assets when the country is with its back against the wall, because the bidders in the market for these assets know that Greece needs to sell. This gives bidders a potential advantage to lower the price at which the assets change hands. This concern has some merit, even though it is the outcome of poor planning on the part of the Greek political system, which ultimately is the guardian of the taxpayers’/citizens’ public sector wealth.

Now let us consider the incentives for the creditors, the European Union partner countries. These want Greece to sell state assets, not just to generate cash flow to lower the debt (balance sheet shortening), but also to give a boost to the structural reform program that Greece so desperately needs to improve productivity in the country’s macroeconomy. Creditors prefer sound regulation over the state owning productive assets, because, as we have argued above, political systems are not the best equipped, given their comparative advantage and disadvantage, to own and run commercial assets.

One wonders then if this juxtaposition of circumstances opens up an option for incentive-compatible debt relief, which involves a conditional debt reduction. Specifically, could creditors discuss the possibility of recognizing some of the valid arguments that it is difficult for Greece, practically and politically, to sell assets at bargain basement prices, and therefore offer a (temporary) bonus every time that Greece reaches a certain milestone in the asset divestment program?

For instance, let us assume that Greece accumulates 5 billion euros in state asset sales (this is reasonably easy to monitor). Could creditor countries then say, “We will write off, or subsidize, whatever is the terminology that does not interfere with European agreements and legislation on such matters, an equal amount of 5 billion euros in Greek debt”?

This means that Greece receives a bonus of 100 percent on the price that it sells the assets for. It also means that the structural reform program receives a big boost from making asset sales “incentive-compatible” with shifting state assets to private sector management. Thus, the creditors get something valuable and Greece gets something valuable – that is the spirit of incentive compatible solutions.

Some may say that this is impossible, because if the eurozone were to do this for Greece, it would have to do this for all European countries with loans from the partner countries and European Stability Mechanism (ESM) and it is illegal to extend such benefits for any one country in the Union. But here, there is a curiosity of circumstances, because there is one debt that is a bilateral arrangement between Greece and the partner countries, and that is the Greek Loan Facility (GLF) of 50 billion euros that was created before any of the eurozone structures to deal with the crisis were put into place. No other country has such a debt component.

Thus, is it possible that a cooperative arrangement could be made whereby Greece continues or even intensifies its asset divestment program, and then for every cumulative 5 billion euros in sales, the euro partners lower the obligation in the GLF by 5 billion euros as well? This step should be repeatable at equal terms. This would need to be structured so that for every 5 billion euros in sales, the debt declines by 10 billion euros (Greece cannot “spend” the 5-billion-euro cash flow from asset sales), which would be a material support for lowering the debt to the target Maastricht debt ceiling.

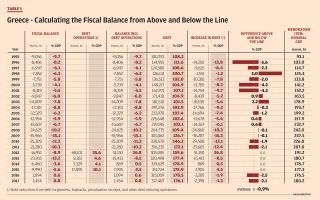

At the time that this Note was first drafted, the summer of 2018, Eurobank published a helpful overview table on Page 38 of its July, 2018 issue of “Economy & Markets.” If I read the table correctly, then Greece had up until that point accumulated 9.9 billion euros in sales on a commitment basis and 4.7 billion euros on a cash basis. Thus, almost 5 billion euros in debt buyback (with the cash portion) should have already taken place, so that Greece could qualify soon, under the plan proposed above, to get a write-down of the GLF of a same amount. On a commitment basis, there is then potentially a second installment in the offing as the cash proceeds further materialize. The debt could then be bought back progressively with these ongoing proceeds.

An arrangement of this kind could be a substantial improvement for the asset divestment program and show strong good-will both on the part of Greece and the eurozone partner countries. Since it involves a unique debt instrument, the GLF, the partner countries may be prepared to structure this assistance for Greece, recognizing that repeated vague claims for debt assistance leave much uncertainty and are less valued by markets than a concrete plan that is relatively easy to monitor.

Notice also that Greece then gains a degree of freedom to schedule asset sales, because if the market is not ripe for a divestment today, it may be in better shape tomorrow. The partner countries lose nothing from granting Greece some flexibility in structuring sales adequately over time, since the arrangement depends on cumulative sales of 5 billion euros at every step; it does not depend on the sale of any assets in particular or its timing.

A final word on the assets that Greece may be able to offer in such a program: My personal view is that the assets on the Greek public sector balance sheet are underestimated. The public sector in Greece is not poor, but it has never focused properly on the assets it owns and manages on behalf of the citizens. This needs to change. The asset side of the balance sheet needs as much attention as the liability side. This requires technical work. It has nothing to do with politics and emotions about what the state owns or owes.

Good accounting and good administration are to the benefit of all Greeks. I am confident that Greece must have many more possibilities to manage its debt burden, and indeed reduce the debt creatively, than is generally recognized. Could we assist Odysseus in bringing the people safely home well before 2080?

Bob Traa is an independent economist. This is the 24th in a series of articles by him for Kathimerini titled “Notes for Discussion – Essays on the Greek Macroeconomy.”