Yes, the bailout era is really over

After eight years, on August 20 Greece’s last international bailout program came to an anticlimactic end.

The Greek economy has been restored to growth, the government budget in surplus and the current account close to balance even in the face of higher oil import prices. Greece has been brought back from the brink of economic disaster. More importantly perhaps, the era of reform diktats is over and Greece has the opportunity to reclaim the same kind of constrained economic sovereignty enjoyed by the rest of the European Union and euro area members.

Greece’s additional political and economic degrees of freedom, though, come at a cost. Unshackling from the troika deprives Greek leaders of the political opportunity to simply (continue to) blame the international community for the country’s enduring economic problems.

Structural economic problems remain daunting – unemployment remains extremely high, foreign and domestic investments are impeded by bureaucracy, unsettled property rights and Europe’s probably slowest moving judicial system, and tax evasion is still almost omnipresent.

But responsibility for any failure to continue the economic, administrative and social reform process in Greece, and thereby potentially in the medium-term risk another loss of access to private financial markets, now lies squarely with Greek political leaders.

And yes, government debt is still excessive. But Greece’s euro area partners are rich and patient creditors, who may continue to look over the shoulders of Greek prime ministers in the future, but ultimately know that their money will never be fully repaid. The longer Greek political leaders manage to keep the country out of the headlines, the easier it will politically become at some point in the future to finally forgive much of the debt.

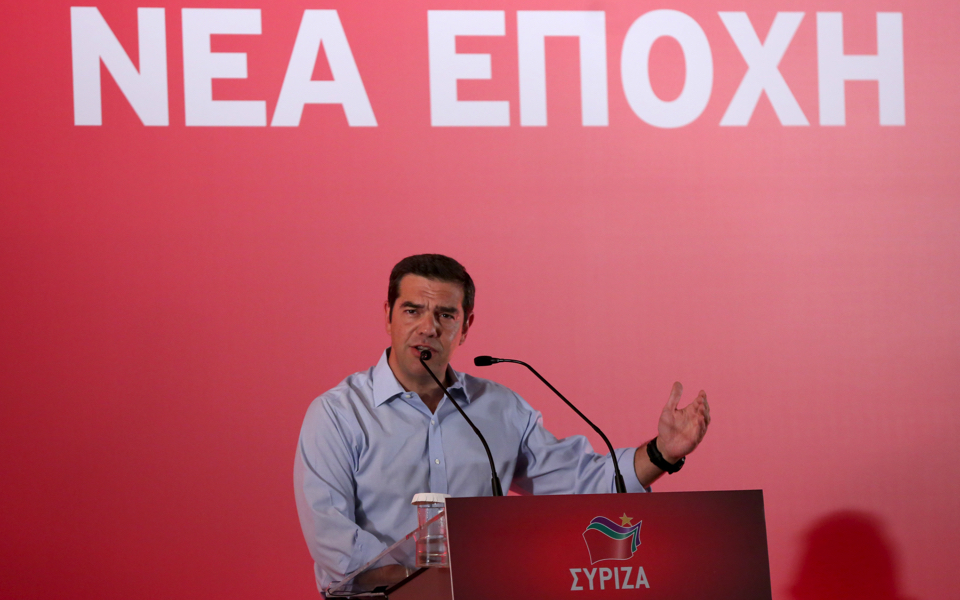

This will require that Greece uses its newfound freedom to develop more stable politics. The threat of chaos and euro exit in the bailout era converted SYRIZA into a stability seeking governing party, but we do not yet know if it will remain responsible once in opposition. Greece’s ability to ensure that bailouts do not return in the future depends on it.

Jacob Kirkegaard is senior fellow at the Peterson Institute for International Economics in Washington.