Banks, elections key 2019 challenges for the economy

The state of the credit sector is probably the biggest challenge facing the Greek economy in 2019, with analysts stressing that finding a swift and credible solution for clearing bank portfolios of nonperforming loans is essential to an economic recovery. At the same time, economists and analysts say, general elections need to take place as early as possible so as to ease uncertainty for Greece over what they call a “lost” year due to the freezing of reforms in the run-up to the polls.

“The major theme in Greece remains the solvency of the banking system,” Michael Hewson, chief market analyst for CMC Markets in London, tells Kathimerini. “Until politicians are able to coalesce around a single formula to recapitalize the banking system and sort out the NPLs, the economy will continue to struggle,” he warns.

“A big challenge for Greece in 2019 will be how to deal with banks,” notes Gianluca Ziglio, senior fixed income analyst at Continuum Economics. “A cleanup of their balance sheets remains a key precondition for halting deleveraging, increasing bank lending and therefore support the economic recovery. However, doing so too abruptly could create dangerous capital shortfalls which must be avoided to avoid a collapse of the banking sector,” he says in comments to Kathimerini.

“Ring-fencing banks and creating a centralized ‘bad bank’ or financial stabilization fund along the lines of Germany’s to manage bad-debt run-offs with the government guaranteeing its funding by leveraging indirectly on its cash buffer could be a sensible option. The problem could be the time needed to rebuild sufficient confidence in the government to run such a scheme but I think rebuilding confidence needs to be prioritized for bank stabilization to be achieved most effectively without fire sales of bank loans to vulture funds or similar likely leading to massive writedowns and capital shortfalls,” adds Ziglio.

The other major challenge for 2019 will be the election agenda, which analysts warn will lead to a delay in reforms, with fiscal risks returning.

Athanasios Vamvakidis, managing director and head of European G10 foreign exchange strategy for BofA Merrill Lynch, tells Kathimerini of the danger of 2019 becoming a wasted year in terms of reforms.

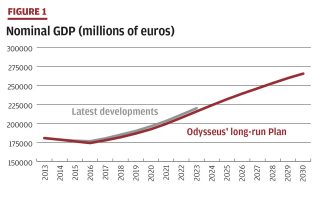

“With three elections in Greece, it is very likely that no major reforms will take place and we could even see policy slippages, questioning the long-term recovery prospects. Greece has no time to waste in the post-program period. The recovery of the economy is extremely weak. It is actually the weakest recovery ever, following a crisis in an advanced economy. Only decisive progress in reforms that will attract investment can bring the Greek economy back to life,” he says.

Greece can save 2019 by pushing elections forward, argues Wolfango Piccoli, co-president of Teneo Intelligence.

“In the best-case scenario, the general elections will be brought forward to May so that the second half of the year would not necessarily be written off,” he says.

“A likely election victory by New Democracy has the potential to attract investors’ interest, but the initial enthusiasm could evaporate quickly if the new government fails to pass some business-friendly measures in the first period in office. On this matter, the key concern is intra-ND tensions hampering the government’s action,” Piccoli warns.

The key to Greece’s return to the money markets, from which it has been absent since February 2018, lies in the completion of the election process, retorts Ziglio. “Greece’s ability to successfully return to the markets next year will obviously depend on market conditions, which are likely to be much more favorable given that Italy’s confrontation with the EU has now been put off, as well as on Greece’s own ability to foster investor confidence via continuity and predictability in policies. A successful return to the market, measured by the ability to issue one or two new bonds via banks and eventually being able to hold auctions to reopen them, would also allow to cover most of its 2019 gross financial needs and leave the cash buffer almost intact, continuing to keep it as an adequate backstop and a guarantee for future refinancing,” the Continuum Economics analyst explains.

Similarly, as Joao Almeida, economist at Morgan Stanley, says in a note to clients, “Greece exited its third adjustment program without any backstop. The return to the market is now the next challenge. Greece has a large cash buffer which can cover many months of funding needs. This is quite positive, but the ultimate goal is to reestablish continued market access.”

Analysts also point to the various external risks next year holds for Greece.

“With European growth slowing, the Fed and the ECB tightening monetary policies, the Italian fiscal situation deteriorating, rising populism before the EU parliamentary elections and uncertainty from Trump policies that are increasing aversion to risk assets, Greece faces a very adverse external environment that could affect negatively its recovery prospects and make it very difficult to re-access markets,” says Vamvakidis.

Almeida added to Morgan Stanley clients that “higher uncertainty about European politics and debt sustainability in the periphery have brought extra volatility. And, with the European Central Bank set to end QE at year-end, there’s perhaps scope for this to persist. All this will create extra challenges to Greece, even if the economy shows some signs of improvement. Credible fiscal strategies and a strong reform agenda can certainly help, yet with a general election looming in the short term, markets ponder any risks of higher instability, which could affect the recovery.”