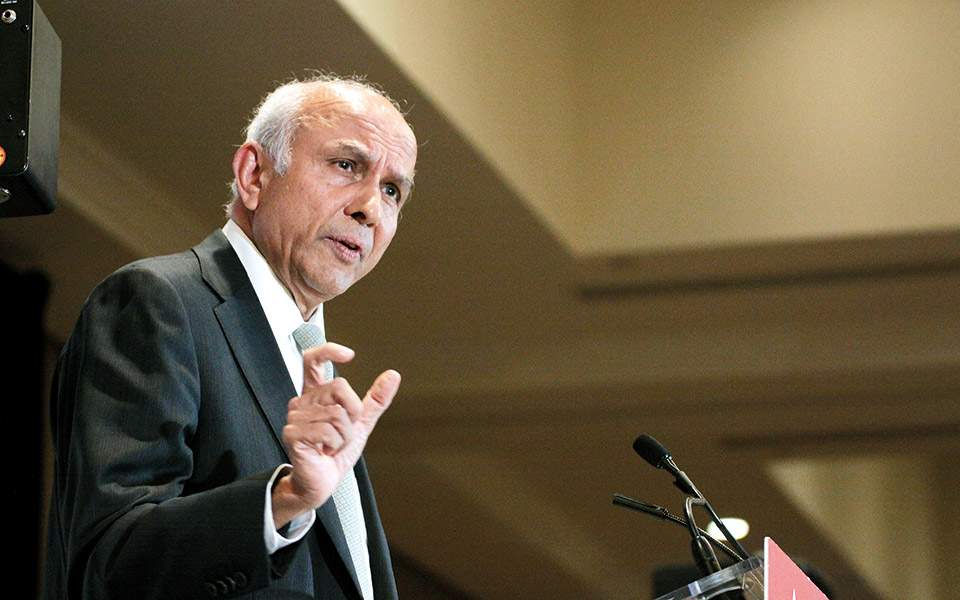

Prem Watsa: Wait, Greece will do great

Prem Watsa, the founder, chairman, CEO and largest shareholder of Fairfax Financial Holdings, is especially bullish about the Greek economy’s prospects and is clearly happy the country has opened up its economy following the coronavirus lockdown.

In an interview with Kathimerini, Watsa says Greece has nothing to envy in other countries and that he believes it can attract enough investment to rebound. As expected from a Greek bank shareholder, the local banking system and insurance market get his vote of confidence. He speaks about the Mitsotakis government in glowing terms and implies that the Greek economy’s rebound is only a matter of time.

How do you appraise the situation in Greece following the pandemic?

I hear the government has done a terrific job as far as the coronavirus is concerned: Closed sooner than anyone else, took it very seriously and is now fully opening the country; hotels are opening and there is some concern about tourism, but the sector will come back in spades. Once you open, you get human creativity, you allow that to take place. So, kudos to the government. They have done a terrific job. It is one year after Prime Minister Kyriakos Mitsotakis got elected and, if you look at Europe, Greece has the best government: business-friendly, with compassion for low-income people, has been sensitive to pensioners. Making it easier to attract business to Greece. The Elliniko project is ready to go. It will be a big plus for Greece. From the outside, I have to say the government has done a terrific job, given the Covid-19 and the refugee crisis from Turkey, and has been able to really focus on law and order. And, of course, that’s been reflected in the Greek debt. Greece’s interest rates have come down to 1.3 percent, from 2.3 percent last year and from dizzying heights in previous years. Of course, the big plus is that, for the first time, the European Union is committing $830 billion in stimulus spending, just like the United States. The good thing about that is that it keeps Europe together. Greece will get its share. And I see lot of investments coming back and a rebound taking place. And I see that possibility for Greece, still. To become one of the best. A lot of pent-up demand and the government could transform Greece, as I mentioned previously. As for Eurobank, it is in a very strong position, it is the best bank in Greece in terms of NPLs. We haven’t changed anything in our position and we still own about 32% in Eurobank and we’re very happy with it. And I’m very, very pleased with Eurolife.

Which economic sectors in Greece do you see as promising over the next few years?

When the economy grows, it’s across the board. When you’re a bank, you deal with all the sectors. So, I think the Greek banks will do very well; I think the insurance business will do very well. We do not separate by sectors in our investments – we’re very specific who we deal with. We want good companies run by honest, hardworking people. Fairfax now writes insurance all over the world, we write $17 billion US in gross premium, $20 billion if we include some joint ventures. And we invest in portfolios over $40 billion US. The pandemic was a very unexpected development and caused people to panic; there was so much uncertainty. And now as the economies are opening up, the uncertainty is going away. Shanghai, in China, has opened up. In the United States, Orlando is opening up all hotels, all attractions, and that’s where the NBA will resume play. People are adjusting: But you can only adjust when the countries open to business and that’s what’s happening, and I’m sure it will be the same for Greece and I’m sure tourism will come back. Greece is such a beautiful country; I happen to have been to one of your islands, Paros.

You are a global business leader. There’s a lot of talk about globalization being over after the Covid-19 crisis. Do you buy that or do you think it’s nonsense?

No, I don’t think globalization is going to end. I think China and the United States need each other; China sells to the United States, some of the biggest companies in China are American companies. I think we will always be fine-tuning globalization; the world is linked today and the communications are fantastic; we can work from home because we have all these different platforms. I think there will be some changes. For example, some manufacturing will come back to America, and there will be a new give-and-take but, you remember, this was also said when Japan slipped up in the 1990s. But, you know, business is global.

In Greece, the business community, especially young businessmen, had this notion back in 2014 that the country was about to take off. Then, we know what happened. Now, over the last few months, they thought the same again until the Covid crisis came. What would you tell these people?

I say to them that life is such, you have these ups and downs. Who would have ever predicted that the world would stop? And to young businessmen, you must always think something can happen and you have to have enough cash, and enough flexibility. They should have a bank line of credit that you don’t need right now and be financially sound. Remember that volcano ash that came out of Iceland and all flights through that part of the world were canceled? And if you had an airline you could go bankrupt – you have to have enough cash. The same is happening now with airlines in the United States. I would tell young Greek businessmen: “Hold on, because Greece will do very, very well and you’ve got a terrific government, a very sensitive government, which is business-friendly. Countries that attract investment are the ones that do well, and Greece is now in the throes of a transformation in terms of attracting business. And business will come to Greece: You got beautiful weather, lovely people, you’ve got terrific infrastructure and technology. You’ve got everything. Your time is about to come. Hold on.”