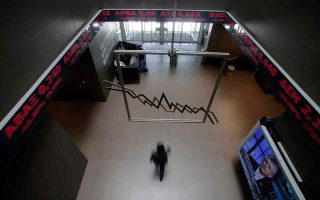

Erdogan spooks ATHEX; loss at 2.42%

Turnover on the Athens Stock Exchange may have risen Monday – to 41.8 million after the auctions – but only because investors gave sell orders, mainly on banks and other blue chips.

In Europe, markets may have ended slightly up, as did Wall Street futures; for the Greek stock market it was the same-old, same-old – we follow international markets when they crash and we go our own way when they rise. The Athens index dropped 2 percent within the first five minutes and stayed there, more or less: The 617.33-point close, a drop of 2.42%, was only slightly up on the intraday low of 613.75.

Analysts seem to agree that Turkish President Recep Tayyip Erdogan’s escalation of tensions in the Eastern Mediterranean was the catalyst for yesterday’s significant correction. As if investors need an excuse to discount the market: Take banks, where the sub-index dropped below 300 points, sliding 4.22%, and Eurobank is the only bank with capitalization over 1 billion. Significantly, it was the least affected among the “big four” retailers, losing 1.33%, while Alpha (-4.62%), National (-6.17%) and Piraeus (-7.56%) underperformed the index, or exceeded it in misery, if you like.