50 tools to usher in tax reductions

The government intends to use as many as 50 instruments to reach its target of expanding the tax base in 2022. The funding for the government’s plans is projected to come from the Next Generation EU recovery program.

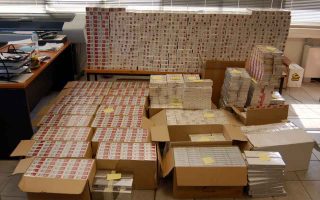

Sources say the plans include the introduction of a labor card, new state-of-the art tills for enterprises and stores that cannot be tampered with, combatting illegal trading and smuggling, the creation of a credit capacity agency for corporations and individuals, among other changes.

These instruments that will be phased into operation starting this year and will form the basis for permanent tax cuts as of 2022, as outlined in the governing party’s election pledges, that have been suspended due to the pandemic.

Plans for 2022 provide for the slashing of the corporate tax rate from 24% to 20%, the permanent abolition of the solidarity levy for all taxpayers, the reduction of tax rates for landlords with incomes from rents, the further reduction of the Single Property Tax (ENFIA) or the abolition of the supplementary property tax for some 500,000 owners, and the gradual abolition of the fee for practicing certain professions.