Asset transfer procedure in just 15 mins

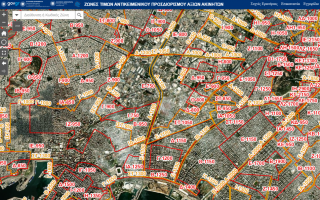

The publication of the new property zone rates to apply as of January 2022 has led to a wave of transactions in the areas where significant hikes are recorded, but now these can take place quickly online.

From now on, the transfer process is conducted through the Independent Authority for Public Revenue’s new online platform “myProperty,” without requiring any visits to a tax office, while doing away with the time-consuming obstacles of bureaucracy.

Estate agents and notaries expect a very busy summer, as taxpayers wish to avoid additional taxes they would incur for transactions in the areas that will see an increase in their taxable rates, known as “objective values,” concerning 55% of the country’s zones.

The online processing of a property transfer may now be completed within just 15 minutes, tax administration officials say. There will be no requirement for filling in forms about the payment of taxes and the calculation of the taxable value of properties. The asset transfer procedure will be conducted in nine digital steps at the notary offices, as they will fill in the declaration form and submit it on behalf of the buyers.