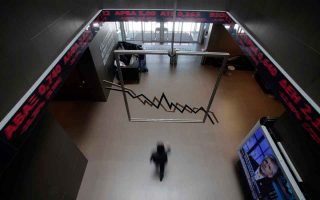

ATHEX: Stocks nosedive on imported fears

There was little doubt that traders would panic once the coronavirus epidemic claimed its first victims in Europe, but Monday’s nosedive at Athinon Avenue wiped about 4 billion euros off the value of the Greek stock market, with the imported concerns from Italy hitting bank stocks hardest.

The Athens Exchange (ATHEX) general index ended at 818.35 points, shedding 8.36 percent from Friday’s 893.03 points. The large-cap FTSE 25 index contracted 7.43 percent to 2,073.73 points.

Domestic analysts branded Monday’s session a “Black Monday,” as it took the benchmark to its biggest daily drop since June 24, 2016, the day of the Brexit referendum in the UK, and to new six-month lows.

The extreme reaction in the Greek market produced a decline that was more than twice that of the Milan stock exchange yesterday, with the high turnover – over 180 million euros – pointing to a massive departure of investors.

Market sources comment that Athinon Avenue remains an emerging and quite shallow market that is vulnerable to shocks.

Τhe banks index slumped 10.97 percent, taking its losses over the last three months to 25.4 percent from the highs of November 2019 – i.e. officially a bear market. Besides the exceptionally negative international environment, bank stocks have been experiencing pressures for a number of days due to investor reservations regarding the efficiency of the Hercules asset protection scheme as the problem of the collateral for the state-guaranteed securities to be issued remains unsolved.

Piraeus Bank sank 14.83 percent, Eurobank plunged 12.03 percent, Alpha dropped 9.65 percent and National decreased 9.47 percent. Public Power Corporation fell 14.52 and GEK Terna shrank 13.56 percent.

A total of 122 stocks headed lower, 13 remained unchanged and just three bucked the trend to post growth.

Turnover amounted to 181.8 million euros, against last Friday’s 85.6 million.

In Nicosia the general index of the Cyprus Stock Exchange declined 1.42 percent to close at 66.01 points.

In contrast, Greek bonds proved to be a safe harbor, as the benchmark 10-year bond’s yield remained in the region of 1 percentage point, while the five-year bond yield showed a decline of up to 6 percent.