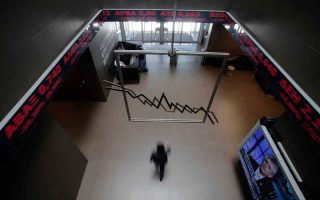

ATHEX: ECB triggers new sell-off

The European Central Bank’s refusal to adjust interest rates to breathe new life into the coronavirus-battered European economy resulted in eurozone securities being subject to a fresh round of sell-offs on Thursday. The Greek stock market plunged to new lows while the benchmark 10-year bond yield soared 51 basis points to 2.08 percentage points.

The Athens Exchange (ATHEX) general index ended at 538.55 points, shedding 10.61 percent from Wednesday’s 602.48 points. The large-cap FTSE 25 index contracted 12.08 percent to 1,344.38 points.

Τhe banks index slumped 16.24 percent, as National tumbled 20.95 percent, Eurobank sank 17.36 percent, Piraeus lost 16.67 percent and Alpha parted with 12.37 percent.

In total eight stocks showed gains, 105 suffered losses and 16 remained unchanged.

Turnover came to 92.8 million euros, up from Wednesday’s 86 million.

The general index of the Cyprus Stock Exchange decreased 7.48 percent to close at 52.66 points.