Covid-19 impact on FDI is expected to be manageable

As the country’s economic activity slows, the question is to what extent the coronavirus epidemic will hurt the investments planned for Greece.

Company chiefs as well as financial analysts have told Kathimerini that the country’s investment prospects aren’t seen changing due to Covid-19, which despite the market crash in Greece and abroad is generally viewed as a temporary situation.

“Investors internationally perceive Covid-19 as an external risk that gradually will be dealt with – possibly within months. In similar crises it has been observed that the more violent the collapse of the markets, the more sudden their rebound when the threat disappears,” the head of a Greek group said to Kathimerini.

Conditions for investment activity within the country may be particularly adverse, but in foreign direct investments the consequences of the epidemic are manageable, analysts say, with the “smart money” seeking out opportunities in times of crises. With the global restrictions on travel having led to the suspension of key business meetings, the investment funds that have offices and groups of partners in Greece (e.g. Fortress, Farallon, HIG Capital, Amber Capital, CVC Capital Partners and Third Point) have an advantage as they keep their focus on Greek assets, such as companies in need of streamlining.

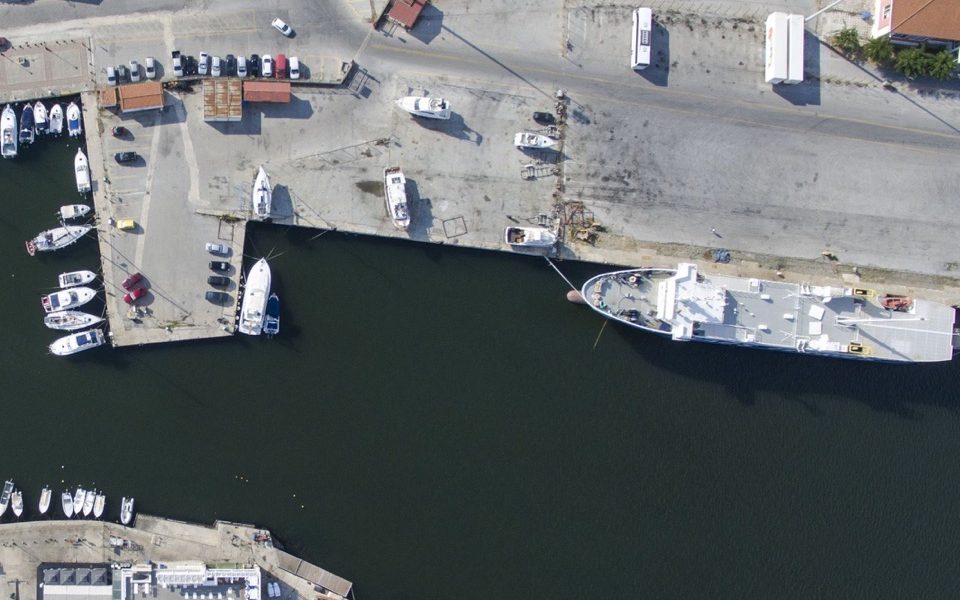

The Covid-19 epidemic will not alter the decisions of US development bank DFC for investments in strategic sectors such as the ports of Alexandroupoli, Volos and Kavala, or the Elefsis Shipyards. Likewise, in privatizations, the interest of foreign and local investors is strong and will be expressed once the pandemic is overcome.