No end to Greek drama anytime soon

Greece is paying the price of a poor negotiation strategy, unrealistic expectations about economic and political reality in the European Union, the lack of progress in implementing reforms and the intransigence of some eurozone officials. This has created a sizable confidence gap between the government and eurozone leaders which will be hard to bridge even if the EU decides to start negotiations and a new bailout program is approved. The Greek drama will likely continue even after a deal.

What a difference a year can make. Up until last September, the former New Democracy-PASOK government was making plans to get the International Monetary Fund out of the Greek program, buoyed by the country’s access to the markets, signs of economic recovery and a better-than-planned fiscal performance. It was also aiming to conclude the last review of the EU program, popularly known as the memorandum, or“mnimonio” in Greek, by moving the thorny issue of pension reform to the future with the consent of European Commission President Jean-Claude Juncker.

The plan did not work for various reasons. Political uncertainty was one of them. The markets took notice of the high risk of snap elections after the main opposition party at the time, SYRIZA, called for a confidence vote and the former coalition government got some 155 votes or so. This did not escape the attention of market participants who knew at least 180 votes were needed to elect a new Greek president in the first quarter of 2015. This, along with the former government’s inaction on reforms since June 2014 and German Finance Minister Wolfgang Schaeuble’s tough stance on the last review of the program, dashed hopes of concluding the EU program.

Less than a year since then, the country has come to the point of facing expulsion from the eurozone. Some international banks and rating agencies already see a “Grexit” as highly likely. This will likely become a reality if the eurozone leaders do not agree to a new bailout loan under the European Stability Mechanism (ESM) soon enough for the country to be able to repay 3.5 billion euros’ worth of Greek bonds owned by the ECB on July 20. If the country fails, the ECB will have to take action and cut off Greek banks from the Eurosystem and the country will de facto depart, experts say.

The outcome of the emergency eurozone summit called to discuss the Greek request for a new program under the ESM was not clear at the time of writing, although the odds in favor of a conditional “yes” had risen. The Eurogroup had reportedly served a note to the summit, outlining the points of convergence and divergence. The note put possible program financing needs at between 82 and 86 billion euros while urgent financing needs were estimated at 7 billion euros by July 20 and an additional 5 billion by mid-August. The Eurogroup invited the institutions “to explore possibilities to reduce the financing envelope through an alternative fiscal path or higher privatization proceeds,” according to the leaked document.

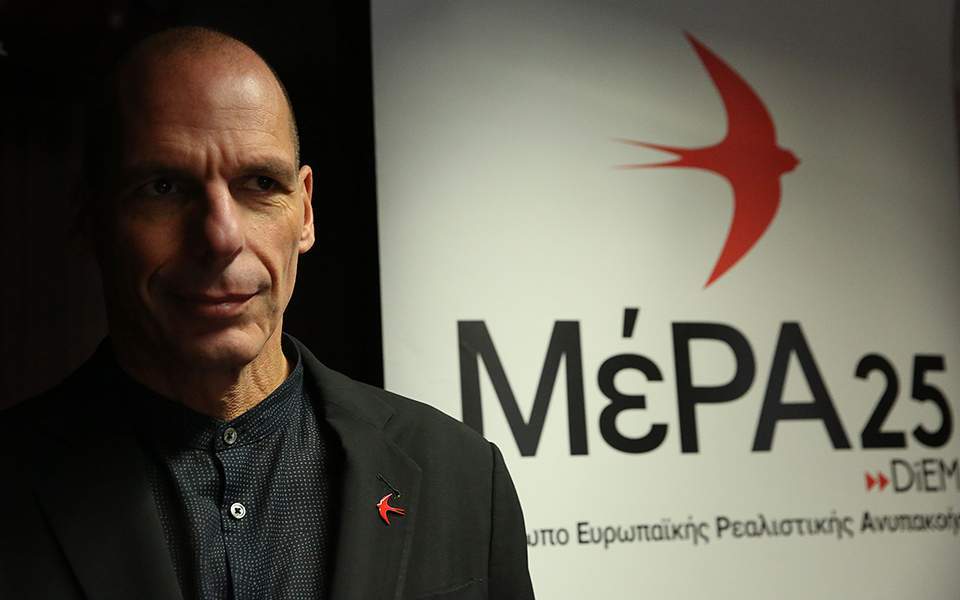

There is no question the Greek side’s negotiation tactics in the last five to six months or so, widely attributed to former Finance Minister Yanis Varoufakis, have cost Greece a lot in terms of credibility in EU circles. Many think the former minister was playing chicken with the creditors, counting on the markets’ negative reaction to secure the best possible deal, but it obviously did not work. Also, the government miscalculated by counting on the support of other southern eurozone countries. The latter turned out to be among the most severe critics of its anti-austerity campaign for political and practical reasons since they undertook similar programs in the recent past.

The reversal of some of the pension and labor market reforms since the SYRIZA-Independent Greeks government took over last January has also called into question Greece’s commitment to reforms. Moreover, many did not like its stance toward Russia, while some comments about Europe being flooded by illegal immigrants made by Defense Minister Panos Kammenos in case Greece went down did not help either. The growing mistrust seems to have played into the hands of some hawks in the eurozone. The latter insist any agreement must be enforced and no further concessions should be granted. Otherwise, financing costs will increase and a large moral hazard problem will be created since other countries will be less willing to carry through the necessary structural reforms. In this sense, Grexit would be the lesser evil. The German finance minister seems to be an advocate of this view.

The lack of confidence is demonstrated by the Eurogroup’s offer for a “time-out” from the eurozone and possible debt restructuring in case no agreement is reached on the bailout program. Even if there is a deal, it will come with strict conditionality and very tight surveillance. Many prior actions will have to be legislated in the next few days to secure the urgent funding. It is obvious the current government cannot carry this burden since it was elected on an anti-austerity platform. So one should expect political developments to unfold in the next few days, weeks and months. A cabinet reshuffle is necessary as a first step but it is hard to see how snap elections will be avoided down the road even if a national unity government is formed.

The tough demands of the lenders for a new bailout loan, a byproduct of mistrust, will have a sizable economic impact and will likely change the political landscape. So, even if there is a deal, the Greek drama will not end anytime soon.