Self-proclaimed ‘trillionaire’ finally in authorities’ sights

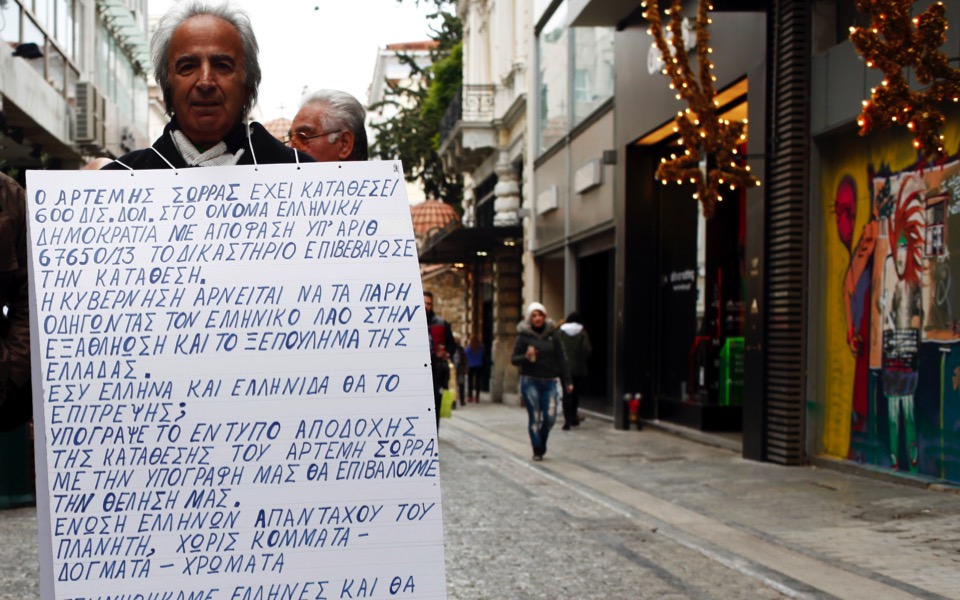

It seems hard to believe that a man has been allowed to spend the last seven years claiming to have so much money that he would be at least 100 times richer than the richest man in the world and promising to pay off Greece’s public debt and the debts of every citizen without scrutiny. The case of self-proclaimed trillionaire Artemis Sorras exposes not just Greeks’ gullibility and their attraction to wild conspiracy theories – particularly those accentuated with his brand of nationalism, inspired by ancient Greece, and rabid anti-Semitism – but also the frightening ineffectiveness of the state apparatus.

Following his acquittal in 2013 on charges of disseminating false information after a complaint by Adonis Georgiadis – former MP for nationalist LAOS and New Democracy minister and now a vice president of ND – Sorras created an organization he called Convention of Greeks. Aided by monthly membership fees from its followers, which number thousands, the organization has opened 208 branches around Greece and abroad. Sorras has also claimed that he will run for prime minister in the next general elections. But his bizarre claims did not garner wider attention and concern until the brutal murder of a child psychiatrist in Lamia, central Greece, in December that led investigators to start looking more intensely into Sorras’s operations. Both the victim and her killer were members of Convention of Greeks.

According to a Bank of Greece document addressed to the financial crime authorities on December 15, the central bank had sent a letter to the country’s banks in November asking to be informed of the veracity of claims made in advertising material for Convention of Greeks that there is enough money available in Greek banks to pay citizens’ debts. The pamphlets allege that there is 115.5 trillion euros – and provide account numbers – which belongs by right to every “native, natural-born Greek.” The so-called data in the advertising material dates to 2007 and contains some farcical mistakes in the names of the banks. Meanwhile, official figures from the Bank of Greece show that deposits in the Greek banking system came to a historic high of 240 billion euros in 2009.

Eurobank and its counterparts Alpha, Attica, National and Piraeus informed the central bank that the account numbers do not exist. Judicial authorities were notified and a preliminary investigation has been conducted by financial crimes authorities into the state of Sorras’s own finances.

Shady background

Sorras began his campaign “for the liberation of Greece” in 2010, after the country signed its first bailout with international creditors, by presenting himself as a multi-billionaire who had inherited shares of Banque d’Orient, a financial institution that merged with National Bank of Greece in 1936 in order to save its depositors from taking a haircut on their savings. According to National Bank, however, there was no surplus left over after Banque d’Orient was liquidated, so the only compensation its shareholders received was the 200-drachma initial buyout fee.

When the Greek crisis broke out, a group of individuals appeared claiming to be heirs of the Banque d’Orient shareholders and demanding huge amounts of compensation. At the same time, Sorras claimed to have 5 trillion euros’ worth of Banque d’Orient stocks, which he had donated to two nongovernmental organizations (“Greece Shall Never Die” and “End National Debt”) for the elimination of public debt and other causes.

In October 2011, the Third Tax Office of Patra (Sorras’s hometown) in western Greece sent two letters to Sorras informing him that the tax on his claimed donation of eight Banque d’Orient stocks, worth a total of 5.42 trillion euros, came to 27.1 billion euros. In March 2012, the Finance Ministry responded in a typically bureaucratic manner to an inquiry by an MP regarding how the figure of 27.1 billion euros was reached. It added that anything above 500 euros can only be paid to the tax administration by check, noting, however, in what may have been an attempt at deadpan humor, that Sorras’s checks had “not yet been delivered.”

In June 2012, Sorras presented the Consulate General of the Republic of Cyprus in New York with a proposal outlining how he was willing to lend indebted Cyprus 48.9 billion euros, with zero interest and a repayment period of 50-100 years. Then, in late September, he claimed that he gave Greece $600 billion in US treasury bonds in order to pay off the country’s debt and boost economic growth. The funding, he said, was in the form of a 100-year loan with an interest rate of 0.5 percent and came with two conditions: that an audit of the debt would be conducted by an international committee of experts supervised by the Greek Supreme Court and that any politicians or officials who contributed to Greece’s bankruptcy would face judicial action.

At that point, the authorities intervened: On October 4, the Finance Ministry (then under Yannis Stournaras) issued a statement saying that there was no such proposal or offer, stressing that such claims can “only be treated like a joke.” The Bank of Greece had also launched an inquiry and concluded on October 2 that the whole affair was a fraud, while the Bank of Montreal, where Sorras claimed to have made the deposit, denied all knowledge of such a move.

The Americans

The Bank of Greece’s conclusions were confirmed a few months later, in April 2013, by the US Treasury, which, responding to a request from the Bank of Greece, said that the documents presented by Sorras and his so-called business partner Dr Emmanouil Lambrakis, a Greek American, were “not valid negotiable financial instruments” and that they represented “a fraudulent scheme which falsely utilizes names of Department of the Treasury officials.” The Office of the Inspector General at the US Department of the Treasury, in fact, recommended that the Bank of Greece reach out to judicial authorities over the claims.

In June 2013, a first instance court in Athens heard a complaint filed by Georgiadis against Sorras and Lambrakis (Georgiadis, as president of the Parliament Committee for Greeks of the Diaspora, had crossed swords on television with Lambrakis over the issue of the $600 billion). Because it was a complaint and not a suit, Georgiadis was not called to testify and the only witnesses were people who claimed to represent organizations that the Bank of Greece had just months before found to be nonexistent or involved in fraud.

Nevertheless, and despite the recommendation of the US Treasury office, the judge ruled that Sorras was authorized to “manage an amount that came to $600 billion” and that the defendants had “pure motives” in what they had done. The judge forwarded the case to a prosecutor to investigate whether there was a case for criminal charges to be brought against those who had cast aspersions against the benefactor and his associates.

Lambrakis eventually parted ways with Sorras but faces much bigger problems today: He was arrested in December by US federal authorities for signing bogus prescriptions for a powerful and addictive opioid over a five-year period. His former comrade, however, continues his purported war against Greek debt (all members of Convention of Greeks are required to swear a “warrior oath” in order to be accepted). We can only hope that the state and its institutions are finally ready to fight back.