Knowledge Greeks can take to the bank

There was a slightly surreal moment in Greek Parliament recently when New Democracy deputy Nikos Dendias quoted from Bob Dylan’s song “All Along the Watchtower.” He did so to respond to Finance Minister Euclid Tsakalotos, who had earlier used a quotation attributed to Mark Twain (“The reports of my death have been greatly exaggerated”) to dismiss speculation about his lack of public appearances immediately after the February 20 Eurogroup.

“There are many here among us / Who feel that life is but a joke / But you and I, we’ve been through that / And this is not our fate / So let us not talk falsely, now / The hour is getting late,” Dendias told Tsakalotos, whom the New Democracy MP accused of holding back on the true implications of what was agreed between the Greek government and its creditors at the meeting of eurozone finance ministers last month.

If we can set aside the strangeness of two Greek MPs trading quotes drawn from American culture, there is a serious theme that underlies their exchange: the truth, or false talk as Dylan put it.

Truthfulness and accuracy have often been victims in the Greek crisis. Political polarization, ideological dogmatism, complex issues, multiple players and a torrent of numbers have contributed to a confused and contradictory picture often emerging.

Unsurprisingly, politicians love operating on this foggy terrain because they feel they can take advantage of people’s apprehension or lack of comprehension and convince them to follow their path out of the mist.

That makes it even more important that those covering or analyzing events give citizens the best possible tools with which to work out how to leave behind the gloominess and make their own judgments. When the information they receive is incomplete, misleading or just plain wrong, the average voter is left in the lurch and vulnerable to politicians’ whims.

One such example last week was the confusion created by the figures for Greek bank deposits published by the Bank of Greece. Notable international media outlets, as well as local reports, suggested the data, which showed total deposits at 119.75 billion euros at the country’s commercial lenders, meant that Greek private sector deposits fell to their lowest level since November 2001.

Although that assessment is factually correct, there is an important piece of context that some reports did not include. Since December, the Bank of Greece has stopped counting 4.2 billion euros held in the Loans and Consignment Fund and another 2.1 billion euros in the Deposit Guarantee Fund as private sector deposits.

This reclassification substantially changes the picture regarding bank deposits. For instance, if the 6.3 billion euros in deposits mentioned above is added to the January figure, the total is actually the second-highest it has been since last May.

That is not to say January did not produce any worrying numbers: There was a deposit outflow of 1.53 billion euros in the first month of the year. Again, though, this has to be put into context. January has traditionally seen outflows, although this year’s were bigger than in 2015 by around 400 million euros.

When all this data is viewed together, the big picture it provides is that there was an uptick in deposit outflows, likely caused by concerns about the failure of the Greek government and its lenders to conclude the second review, which prompted renewed speculation about political developments and even Greece’s future in the eurozone.

What it does not show is a massive drop in deposits to record low levels in the manner the country experienced in the first half of 2015. After all, that is what the capital controls adopted that summer are still there for, even if the restrictive measures have been relaxed since last year for money being brought back into the banking system.

This clarification about what January’s deposit data tell is important because it is very easy to cause confusion and panic among a population that has been repeatedly battered by the long Greek crisis.

Anywhere in the world, a bank run can develop a momentum of its own that is not necessarily linked to a real threat, let alone in Greece where so many people have been left disoriented and not knowing who to believe.

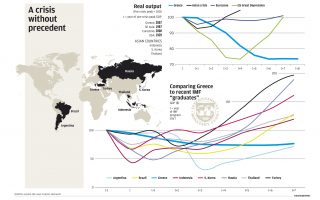

In fact, tracing the inflows and outflows at banks through the crisis gives a very clear picture of Greeks’ hopes and fears since 2010, when total private sector deposits stood at nearly 240 billion euros, or roughly double their current total.

The thirst that Greeks have for positive news and their need to believe in the possibility of recovery was highlighted in the figures contained within the Bank of Greece’s annual report published on February 24. It indicated that since the imposition of capital controls at the end of June 2015, the net inflow of cash reached 7.7 billion euros, 3.1 billion euros invested in foreign securities was repatriated and 4.8 billion euros in deposits returned to the system. This only went a small way to healing the deep wounds caused by the flight of deposits in previous years but was a reminder that a stable, hopeful environment can instill confidence in people.

Having now seen both sides of the story – how banishing uncertainty can benefit the country’s economy and how fear can undermine it – Greece should not be in any doubt about how this process works.

Although January’s deposit figures were not as dramatic as they seemed at first sight, they were still a strong warning that if the current efforts to conclude the second review go awry, confidence will be severely damaged and the hopes for an economic recovery this year will be obliterated.

Twain’s observation that “the secret to getting ahead is getting started” seems to be suitable in Greece’s current situation. Perhaps Dylan’s line from “Subterranean Homesick Blues” might be even more appropriate: “Keep a clean nose / Wash the plain clothes / You don’t need a weather man / To know which way the wind blows.”