Possible pressures on public debt: Part 2

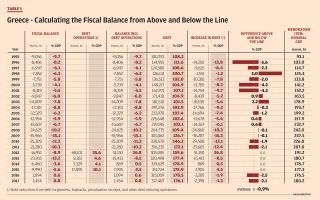

The previous Note for Discussion demonstrated that there are fiscal operations that give rise to debt that are not included in the reported fiscal balance. This is a problem. It means that the reported fiscal balance is not always a good indicator of what happens to the debt. One should always check the variation in debt against the reported deficit and see if these two numbers are the same. If not, an explanation is due.

In this Note we look forward and ask the question: What organic factors do we have to watch to anticipate further pressures on the debt as the economy moves on? Two factors come to mind immediately: rising effective interest on the debt, and aging of the population. We will look at interest rates in this Note, and aging in the following one.

Figure 1 below shows the ratio of the stock of debt to GDP and the effective average interest rate that Greece paid on its stock of debt. Two observations emerge: First, the debt has always been too high, over 100 percent of GDP. This became a huge problem in the crisis when the debt ratio zoomed up to around 180 percent of GDP. Second, the average effective interest rate on the debt fell upon entry into the eurozone, and then, with the onset of the crisis, fell even further. The latter is a stunner. When the debt ratio rises, risks for credit markets increase and the effective interest rate that markets will charge will rise – not fall. So, what is going on?

When Greece came close to defaulting on its debt, eurozone partner countries and cooperating institutions bailed Greece out. How? By providing credit to Greece at well below market rates so that Greece could stay current on as much debt as possible (there was a default on private debt in 2012). A huge share of debt was refinanced to the European taxpayers in partner countries at vastly lower interest rates. This is a political operation, it is not a market operation. The market would not permit a higher debt ratio with lower effective interest rates. While Greece has not received an outright haircut on the face value of official debt, the benefit from refinancing at very low interest rates has been enormous. This, too, is a form of debt forgiveness, except that it takes place in the form of lowering interest costs and postponing amortizations (so-called flow restructuring), rather than cutting the debt outright (stock restructuring).

Before the crisis, the effective interest rate charged to Greece on the debt was around 4.5 percent (lower panel). By 2017, this effective interest rate had been lowered to 1.8 percent. On the stock of debt outstanding at end-2016, this difference in the interest rate is worth 8.6 billion euros, or 4.8 percent of GDP. Thus, if Greece had continued paying “normal” interest rates on its debt, there would not be a surplus today, but rather a large deficit (because of the higher interest bill) and the debt ratio would be on an explosive path to overall default. This very large interest rate benefit granted by partner countries occurs every year and is cumulative. Furthermore, partner countries have also granted Greece grace periods in servicing debt principle and deferred interest, so the interest rate charged does not reflect the full risk premium, nor the full liquidity premium. Those who are of the view that partner countries are not doing enough for Greece are not familiar with the material.

Now Greece has expressed a preference to exit the programs and go it alone, with only monitoring assistance provided by the partner countries and European Union institutions. This means that going forward, if Greece needs to access the market, it needs to pay market interest rates – there will no longer be a subsidy on the cost of the new debt that will need to be placed to roll over old debt that comes due. Hence, going forward, the average effective interest rate on Greek debt will increase. The crucial question is how much and how fast?

The International Monetary Fund staff report for the 2018 Art IV Consultation informs in its Debt Sustainability Assessment that the EU institutions and the IMF have slightly different assumptions as to how high the effective interest rate will go in future. It notes that the EU uses an average interest rate on official debt for the period 2018-2060 of 2.8 percent and a market interest rate of 4.7 percent. The IMF uses an average interest rate on official debt of 2.9 percent and a market interest rate of 5.7 percent. These differences may not seem very large to the uninitiated, but they compound into the debt over time and become significant. This is one reason why the IMF has a more somber outlook for debt sustainability than the European institutions. It projects that the debt ratio would start rising again from 2038 onward.

I do not have the granular information on different classes of debt that the staff of the IMF and EU institutions have, so I have employed a slightly more back-of-the-envelope strategy to ascertain by how much and how fast the interest bill may rise for Greece in future. Figure 2 shows the basics.

For the past, the nominal and real interest rates are given, with the real interest rate defined as the nominal rate minus inflation as measured by the GDP deflator. For the future I rely again on Mr Euler and his beautiful equations for dynamic systems. The so-called transversality equation tells us that the debt ratio is related to the difference of the real interest rate and the real growth rate of GDP (r-q) and the fiscal primary balance. Without going into further detail, it suffices to say that this term (r-q) is variable but tends to gravitate to 1 percent, or 100 basis points. This means that in the steady state the real interest rate tends to be some 100 basis points higher than the rate of growth in real GDP. Now, since in previous Notes we have derived a possible path for the rate of growth in real GDP (from demographics and an aspirational productivity assumption), we can now project a possible/likely path for average real interest rate, namely 1 percentage point higher than the path for real GDP growth. This is the dotted line in the projections shown in Figure 2. The nominal interest rate is then the real interest rate plus projected inflation as measured by the GDP deflator (1.75 percent in the future). This is the solid line in Figure 2 above.

Closing thoughts

This simulation for the Greek economy gives me the following summary results:

– The 2017 average nominal effective interest rate on the debt is 1.75 percent.

– This rate is projected to rise to around 3.5 percent in the transition period.

– The difference between the “subsidized” rate in 2017 and the steady state rate is thus also 1.75 percent. This means that the equivalent effective interest bill would double, in euros, from what Greece pays in 2018. This is only the interest rate effect (the cost of debt); if Greece runs future deficits then the debt stock would rise and the interest bill would go up further (compounding the additional volume effect).

– These simulations suggest that Greece needs to foresee and plan that in the future, as the lower interest rates are phased out, the interest bill for the budget could increase by a full 1 percent of GDP.

– If Greece wants to run roughly a balanced budget in the future, to bring the debt ratio down, then the primary balance effort needs to be strengthened by up to 1 percent of GDP. The higher interest bill, as interest rates normalize, will then be crowding out some primary expenditures. Is the country prepared to do this?

– The Debt Sustainability Assessments by the IMF and the EU show the same effect that I describe here: The rising interest rates on the debt will provide a headwind to lowering the debt and this complicates the outlook. This is one reason why Greece needs to run strong fiscal policies for a long time to bring the debt ratio down to truly lower levels. If debt reduction is important, then there is no “fiscal space” for new spending. But the government could still make some reallocations within the overall budget to conduct fiscal policy and express political preferences, until the debt ratio drops to much lower levels.

Bob Traa is an independent economist. This is the 11th in a series of articles by him for Kathimerini titled “Notes for Discussion – Essays on the Greek Macroeconomy.”