Why China has passed its economic growth peak

Investors and stock markets have become very excited with China’s “reopening” after its abandonment of the zero-Covid policy at the end of 2022. Nobody knows how many people died after more than 80% of the population was declared to have caught the coronavirus, but there have been clear signs of economic revival after three years of drastic lockdowns. Does that mean China will return to the high growth rates of recent decades?

While its growth will undoubtedly recover to impressive rates in the short term, there is good reason to think that China’s era of miraculous economic expansion is now behind us. This is due both to structural issues that cannot easily be addressed and to policy mistakes that could be, but have not been fixed so far.

First, the structural problems. Long-term economic growth depends mostly on three factors: growth of labor supply, efficiency of investment, and innovation. Chinese industry benefited immensely from an abundant and cheap labor supply pouring from the countryside. This is over. Labor supply will start shrinking more and more, and recent demographic trends will only accelerate this phenomenon. The aging of China’s population is deeply structural and is unlikely to be reversed. According to moderate projections by Pew Research Center, China’s population will almost half by 2100, dropping to 767 million, from 1.426 billion today.

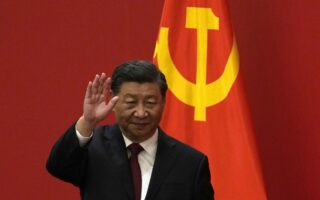

Efficiency of investment also exhibits a declining trajectory after Xi Jinping’s crackdown on the private sector. The Chinese president instead relies on the less effective public sector, which is firmly under the Chinese Communist Party’s grip, further sidelining private enterprise. Jack Ma, founder of “Chinese Amazon” Alibaba but also symbol of the CCP’s crackdown on private business, was recently spotted in Australia and is said to be on a “quiet world tour” after having openly questioned the CCP’s policies on regulation of the high-tech sector. Moreover, after the infrastructure investment boom of the last 20 years, its additional benefits are significantly diminished.

Innovation is taking a hit from the crackdown on high-tech, but there are also quite a few other reasons why it will slow down. To begin with, Western countries are increasingly protecting themselves from China’s copying of advanced technologies and it will have to rely only on its own capabilities. Second, research inside China operates in an atmosphere of oppression and lack of individual freedom. Xi is betting on a “dual” system where STEM research is completely free while social sciences are fully under control of the party. One may nevertheless wonder how much the lack of total freedom of the mind hinders research productivity. China is spending a lot of money on innovation but only under the supervision of political commissars, who discourage creativity and non-conformism. These stifling effects may be fostered by China’s millennial collectivist culture that frowns on deviations from conformity and as such is less conducive to innovation.

Long-term economic growth depends mostly on three factors: growth of labor supply, efficiency of investment, and innovation

On top of these structural problems, the CCP’s policy mistakes will undoubtedly exacerbate the country’s growth slowdown. First of all, the deficits of local governments and the connected real estate crisis, where local government sold land to developers to cover their deficit, leading to the now bursting real estate bubble, have not been addressed. The foundations of Evergrande, China’s mammoth real estate company with total assets north of $300 billion, are shaking with consequences yet to be revealed.

Second, despite a declared shift towards increased consumption, its share of the Chinese GDP remains low, barely above 50%, compared to 65% in most advanced economies. This is not good news for aggregate demand. Third, many countries to which China lent money under the Belt and Road Initiative are not reimbursing their debt. Such phenomena place additional burdens on the Chinese balance sheets and could proliferate as the world economy begins to face recessionary pressures.

Last but not least, even if supply chains recover fast from the zero-Covid policy, China’s assertive foreign policy negatively affects the country’s exports. There were reports of Chinese balloons, with one being shot down over US territorial waters in early February. China’s “bullying” of countries like Australia, Lithuania and now the Czech Republic incentivizes the US, Europe and their allies to diversify their international trade and reduce their dependence on Chinese goods. Such developments would attenuate the Chinese economy’s growth engines.

Over the past 40 years, the Chinese “growth miracle” has lifted some 800 million people out of extreme poverty. Although unprecedented in its manifestation, there are many reasons to believe that China’s growth heyday has passed, despite the current post-Covid growth spurt. The implications are ahead. The legitimacy of China’s Communist Party has relied in previous decades on the growth miracle. The end of high growth rates in the long run will be a headache for China’s leaders.

Gerard Roland is the E. Morris Cox Professor of Economics and professor of political science at the University of California, Berkeley, and Nikolas Neos is an economist.