Greece’s tax-evading professionals

Greece would be much better off if the government could collect the taxes owed by the self-employed. That's the lesson from a paper released this month that uses an innovative method of capturing tax evasion.

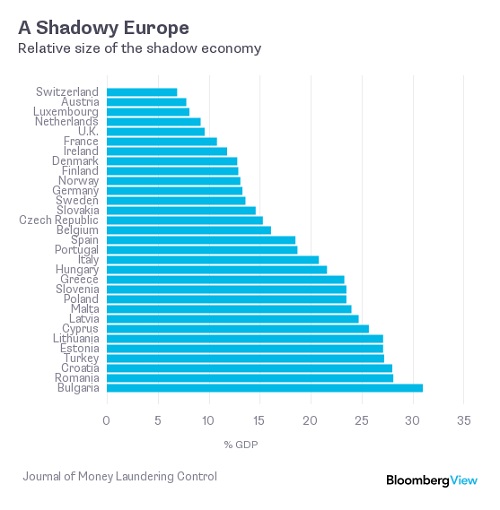

Estimating shadow economies is tough. Friedrich Schneider of the Johannes Kepler University of Linz in Austria, Europe's leading authority on the subject, has pointed out that none of the accepted methods is completely reliable. For example, comparing expenditure and income statistics isn't ideal because the results are distorted by omissions and errors in national accounts; and using indicators such as electricity consumption doesn't take into account shadow sector activities that don't require much energy. Still, Schneider measures Europe's shadow economies annually. Here are the 2014 estimates from a paper he published this year with two collaborators:

In gross domestic product terms, Greece has the second biggest shadow economy among European Union countries without a Communist past – after Cyprus. Schneider estimates that, in Greece, unreported revenue accounts for 23.3 percent of GDP, or $55.3 billion. That includes illegal activities such as the drug trade and prostitution, as well as activity in the legitimate economy. Had it been subject to taxes – at the prevailing 40 percent rate – the shadow economy would have contributed $22 billion to the government's coffers, arguably enough to make international bailouts unnecessary.

The latest paper – by Nikolaos Artavanis of the Isenberg School of Management, Margarita Tsoutsoura of the University of Chicago and Adair Morse of the University of California at Berkeley – the unreported incomes of self-employed workers account for about half of the total.

The researchers used loan application data from a big Greek bank. On average, the bank's clients would need to spend 78 percent of their officially reported income to service the loans they requested. The bank, however, regards the reported income figure as a fiction, as do many other banks in eastern and southern Europe. As a result, it uses estimates of “soft” – untaxed – income for its risk-scoring model. Artavanis, Tsoutsoura and Morse recreated these estimates and concluded that the true income of self-employed workers in Greece is 75 percent to 84 percent higher than the reported one. In 2006-2009, that meant 9 billion euros ($10.1 billion) to 11 billion euros a year in lost revenue for the Greek government.

The tax evasion is concentrated in highly educated and powerful professions, the researchers found. On average, a medical professional evaded 32,500 euros a year in taxes. And Greece has the EU's highest self-employment rate: Almost a third of Greeks work for themselves.

Even the leftist government of former Prime Minister Alexis Tsipras, which came up with unworkable schemes to crack down on tax evasion – from using housewives and tourists to inform on small businesses to a levy on cash withdrawals – failed to lean on Greece's top professionals. Atravanis and others wrote:

“Out of 13 industries, the four most tax-evading industries (medicine, engineering, education, and media) account for 61.7 percent of the non-lawyer Parliamentary votes. If we add in the next two categories (tourism and accounting/finance), the percentage rises to over 80 percent, excluding lawyers, which would also be high on tax evasion. The alignment of the occupational backgrounds of Greek parliamentarians to our top tax-evading industries is only an association, but may suggest one possible reason behind the lack of willpower to enact tax reform.”

Greece's intellectual elite could fix many of the country's economic problems simply by honestly declaring its income. Nobody seems to be interested in applying that kind of pressure, though. The researchers suggest the government should sell occupation licenses through the powerful professional associations: a harsh but effective way to collect more money.

The shadow economy – and particularly the contributions of professionals – is an enormous potential resource for governments. Unfortunately, politicians, who often are from the same professional classes, sometimes turn a blind eye.

[Bloomberg View]