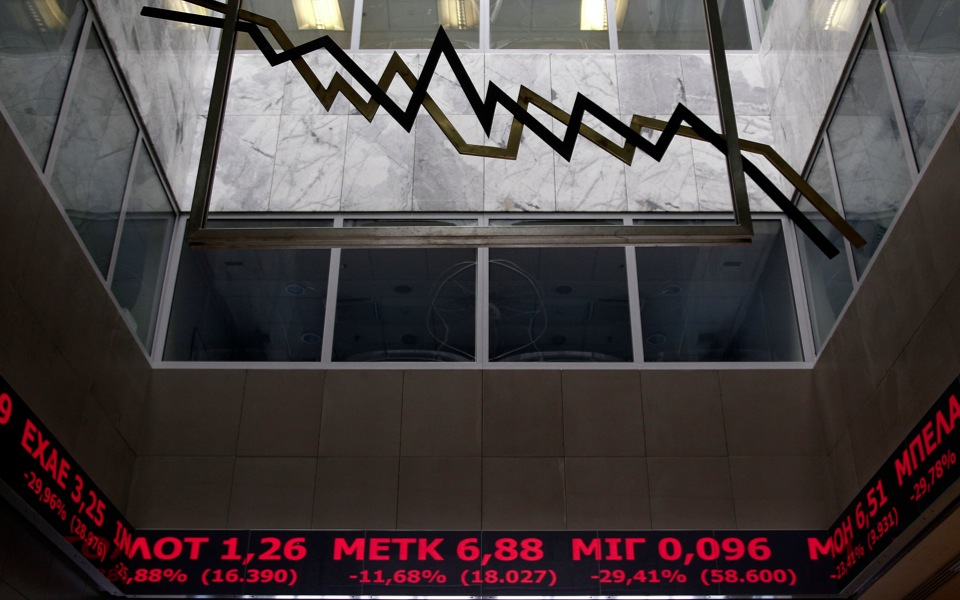

ATHEX: Stocks post fresh decline to 5-week low

The sell-off on the Greek stock market following the completion of the bailout review continued unabated for a fourth day in succession on Monday. Within two days the banks index has given up just under 17 percent, while the benchmark has now fallen below the 600-point mark.

The Athens Exchange (ATHEX) general index closed at 594.58 points – its lowest point in five weeks – shedding 3.89 percent from Friday’s 618.67 points. The large-cap FTSE 25 index contracted 4.50 percent to end at 168.53 points.

As this Thursday’s tranche disbursement approval by the Eurogroup appears a foregone conclusion, the only chance of a boost to the market right now is if the European Central Bank restores the waiver allowing Greece to use “junk-rated” bonds as collateral for liquidity to banks.

Banks fell 7.81 percent, with National giving up 10.40 percent, Piraeus sinking 9.17 percent and Alpha decreasing 6.94 percent. Lamda Development (which has landed the Elliniko project) was the only blue chip to buck the trend, adding 2.16 percent.

In total 26 stocks reported gains, 78 registered losses and 12 stayed put.

Turnover amounted to 85.4 million euros, down from last Friday’s 96.4 million.

In Nicosia the general index of the Cyprus Stock Exchange also headed south, losing 2.19 percent to close at 68.27 points.