Undeclared donations to come under scrutiny

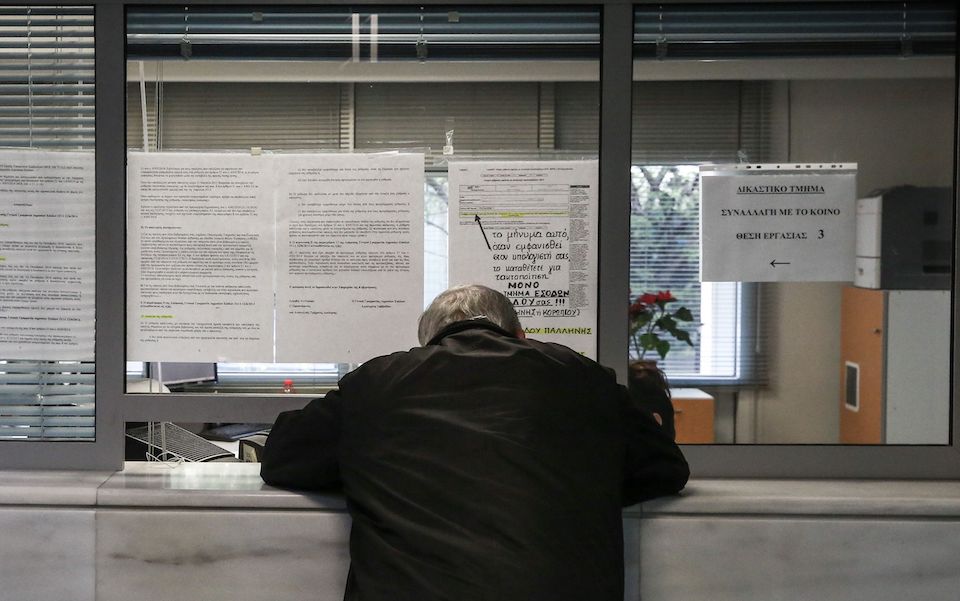

The tax administration is summoning taxpayers who have made donations of money, which are not taxed, but failed to submit the bank document proving that the transaction was conducted through a credit institution.

Donors will have to present documentation to their tax office, while those who can’t will have to pay tax amounting to 10% of the amount donated; furthermore, in the latter cases, the tax authorities will run checks on the origin of the money donated to establish whether it concerns declared revenues – which would mean it has already been taxed – or originates from undeclared income.

The Independent Authority for Public Revenue is expected to issue a circular to tackle any problems, errors or omissions, offering guidelines both to taxpayers and to tax officers, who are facing a storm of questions.

At the same time donations and parental concessions – just like property transactions – are entering the digital era, putting an end to trips to the tax office. According to an IAPR official, the myProperty platform will open next month for the submission of all parental concession and donation tax declarations.