Banks to review charging policy

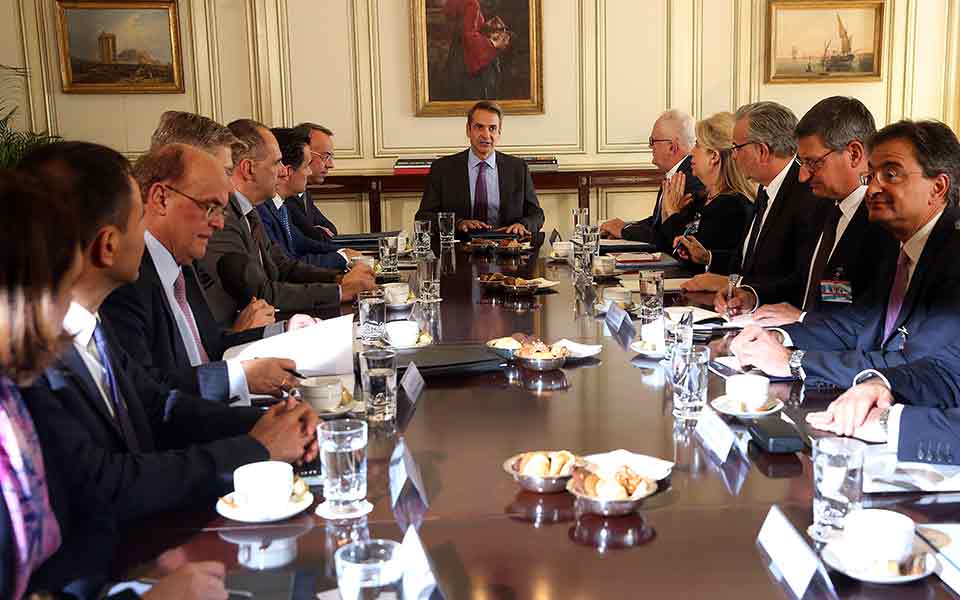

Prime Minister Kyriakos Mitsotakis obtained the pledge of the country’s banks to review their policy on charges such as credit card fees, cash machine usage, PIN issue and online banking at a meeting on Thursday with their chief executive officers.

Mitsotakis told the bank chiefs that the hikes announced are particularly negative: “These increases are not justified, especially when implemented in an improved economic environment. We have to stick to the previous framework,” he reportedly said, asking that charges associated with online transactions be revoked as the government is trying to reduce the use of cash.

Although lenders do not follow a common policy on charges and there are differences in the pricing of various transactions, it is certain that competition between them will force them to reduce or eliminate the commission charges imposed recently.

Sources say that first up will be National Bank, which is seen scrapping the charge of 18 cents it recently imposed for the printing of mini-statements at cash machines. Also under review will be the 6-euro fee for the renewal of debit cards – normally after five years – as well as the 3-euro commission for the reissue of a PIN if the cardholder has lost or forgotten it and asks for a new one.

With the exception of the mini-statement, the other charges have also been adopted (though not in a coordinated fashion) by all other local banks, and it is certain that National’s review of its charges will force its rivals to reassess their policy too due to competition.

The prime minister’s meeting with the CEOs of Alpha, National, Eurobank, Piraeus and Attica saw the lenders’ executives defend their pricing policy, noting that revenues from commissions amount to about half of the European average. However, Mitsotakis expressed his opposition, presenting the initiatives the government has taken to increase online transactions as well as the government efforts to support the credit sector.