Five takeaways from the Sotheby’s art fraud trial

Over the course of three weeks, the art world watched as a Russian oligarch pursued a lawsuit in an American court in which he accused Sotheby’s of abetting a fraud.

The oligarch, Dmitry Rybolovlev, testified in federal court in New York that a Swiss art dealer had cheated him by pretending to be his agent when instead he was buying artworks and flipping them to Rybolovlev’s company at hefty markups. Sotheby’s, he said, was in on it.

But after only a few hours of deliberation Tuesday, the jury found differently, voting unanimously that Sotheby’s had not played a role in any fraud. The dealer, Yves Bouvier, who was not a defendant in the case, said he felt vindicated too.

Bouvier has long insisted that he did nothing wrong and that he was always clearly acting as a dealer, free to charge Rybolovlev whatever price the Russian would pay.

“The New York court proceedings,” Bouvier said in a statement, “were a surreal charade in which people argued over an alleged fraud that had never happened.”

Here are five takeaways from the trial.

His art collection was born of empty walls

Rybolovlev, who made his fortune in potash fertilizer in Russia, described how his interest in art began almost accidentally, “through electricity and lightbulbs.”

The oligarch bought a house in Geneva where the previous owner had installed lighting to illuminate artworks on its walls.

“I had to either get something on the wall,” Rybolovlev said. “Or I had to change something with the house.”

So he bought art. $2 billion’s worth.

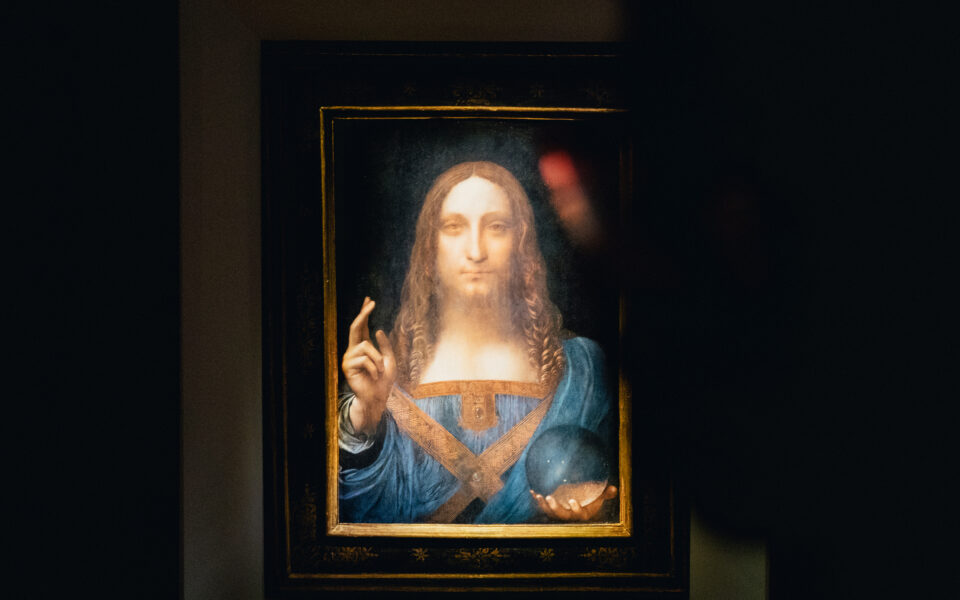

Paintings can get code names

Within Sotheby’s, the project to sell the “Salvator Mundi,” a painting by Leonardo da Vinci, was code-named “Jack,” which came from the name of the character played by another Leonardo – DiCaprio – in the movie “Titanic.” The rationale for the fake name was an outgrowth of the secrecy and confidentiality on which the art market depends.

The code name Sotheby’s used for a transaction involving another painting Rybolovlev bought from Bouvier – “Water Serpents II,” by Gustav Klimt – was “Cottonmouth,” a kind of snake.

The art world operates in some exotic locales

It wasn’t quite a Bond movie, but the trial provided glimpses of the sometimes glamorous locations where the art world lives, socializes and does business:

A warehouse outside Vienna, where Rybolovlev went with a bodyguard to view “Water Serpents II.” Or Rybolovlev’s apartment on Central Park West in Manhattan, where a Sotheby’s expert took a painting in a packing crate for viewing. And then there was the Eden Rock hotel on St Barts, overlooking the turquoise waters of St Jean Bay.

It was at the Eden Rock, over lunch in 2014, that Rybolovlev spoke with Sandy Heller, an art adviser to hedge fund manager and New York Mets owner Steven Cohen, who sold a work to Bouvier that was later flipped to Rybolovlev. The Russian testified that it was in that conversation that he first learned he may have overpaid for the art.

Amelia Brankov, chair of the art market committee of the New York City Bar Association, said it was surprising that collectors “who routinely use contracts and live by the ‘trust but verify’ adage in their business life dispense with this structural support when building their art collections.”

The value of a Leonardo was questioned

Much of the discussion at trial was about the “Salvator Mundi,” a depiction of Christ that Rybolovlev sold in 2017 for $450 million, making it the most expensive artwork ever sold at auction. When Rybolovlev bought it in 2013, the painting was an unheralded work that had only recently been attributed to Leonardo.

One expert, Guy Stair Sainty, a London dealer, suggested in his testimony that Bouvier, who paid $83 million for the work before flipping it to Rybolovlev, may have overpaid at that price, in part because it had “extremely problematic condition issues.”

“It was widely known in the art market that this painting had been marketed to various museums without any success,” Sainty said.

The old master market did not support high prices for the work, he said, adding that paintings with more solid histories had sold for much less.

Bouvier, of course, may have been comforted in knowing that his client, Rybolovlev, had already agreed to pay $127.5 million for the work.

One windfall was probably less of a windfall

Sotheby’s lawyers told the jury that Rybolovlev resold the “Salvator Mundi” for $450 million. They hoped to show that an insurance valuation the auction house had provided, of roughly $114 million in 2015, was not exorbitantly high.

But the oligarch does not appear to have cleared as much as one might think when he sold the painting in 2017 at Christie’s.

Christie’s had arranged for a third party to guarantee that the work would sell for about the estimate of $100 million. In such situations, the guarantor is typically compensated for taking a risk by being given a percentage of the purchase price above the guarantee. So although Rybolovlev made a lot of money on the sale of the Leonardo, it was perhaps not as much as it had seemed.

This article originally appeared in The New York Times.