Six big suitors in two energy tenders

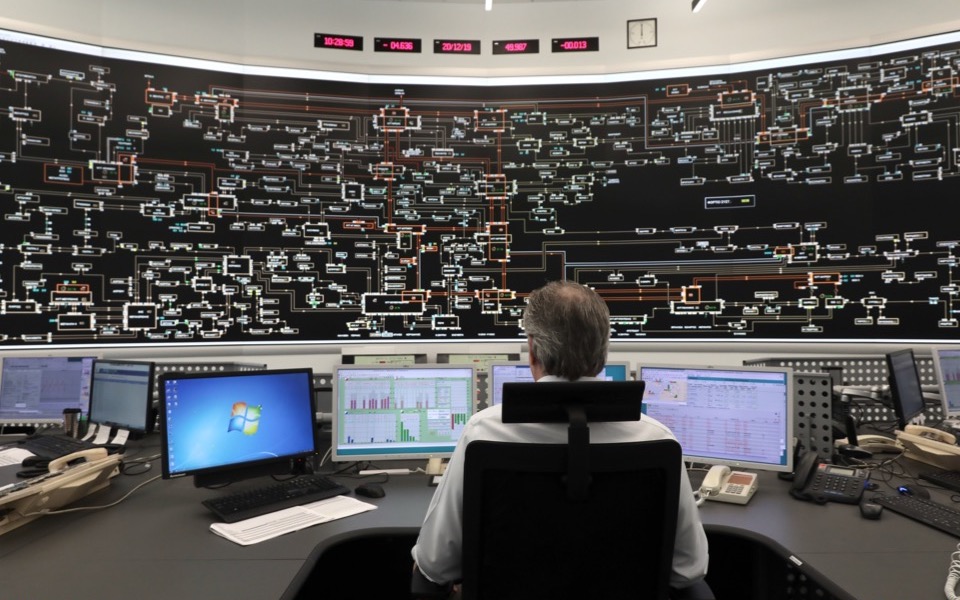

September promises to be a month of developments and clarity for the energy privatization landscape in Greece, with the tenders for the sale of 100% of DEPA Infrastructures and 49% of Hellenic Electricity Distribution Network Operator (DEDDIE) being already close to completion.

The two tenders are proceeding smoothly, mainly thanks to the interest of six parties, attracted by the guaranteed revenues of the two energy grid operators.

What distinguishes the two tenders is that interest in DEDDIE was restricted to major investment funds, while the DEPA Infrastructures sale has attracted strong European grid managers. The fact that Public Power Corporation will not concede the management of DEDDIE along with the 49% stake has kept away from the tender European grid operators such as Italy’s Enel and France’s Enedis, which had informally expressed interest before the process began.

The final battle for DEPA Infrastructures will take place between two of the strongest grid managers in Europe. Vying for full control of the Greek natural gas network are Italgas, the third biggest gas grid operator in Europe, and EP Investment Advisors from the Czech Republic, which is also active in Slovakia, Italy, Ireland, Britain, France and Switzerland.

The process for the DEDDIE stake sale has got nine investment funds shortlisted for the final stage, but interest has practically been reduced to four, that are the strongest both in value and in infrastructure investments.

One of the favorites is CVC Capital Partners, which in the last few years has evolved into one of the major foreign investors in the country. Its rivals include First Sentier, a Luxembourg-based fund that specializes in infrastructures and has assets of $176 billion, and Australian fund Macquarie, which manages funds of about $500 billion and is the largest asset management company in the infrastructures sector in the world.

The fourth and by no means least favorite of the process is American investment group KKR, which controls assets of $200 billion and was first involved in Greece through the Pillarstone bad-loan management platform.