Factbox: Main measures in latest omnibus bill

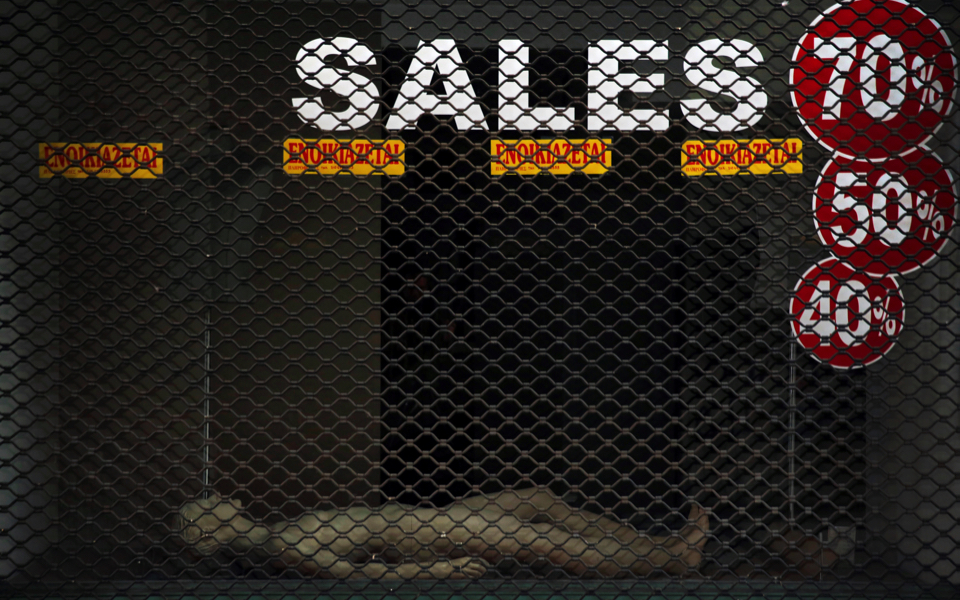

Greek lawmakers approved an omnibus bill late on Thursday, required by the country's official lenders to conclude a crucial bailout review and release more aid to the debt-ridden country.

The legislation contains more austerity measures, including pension cuts and a higher tax burden that will go into effect in 2019-20 to ensure a primary budget surplus, excluding debt servicing outlays, of 3.5 percent of gross domestic product.

Athens needs the bailout funds to repay 7.5 billion euros ($8.35 billion) of debt maturing in July.

The bill also includes relief measures that will kick in only if fiscal targets are met. They include cuts in corporate and individual income tax rates, and reductions in other unpopular levies.

The following are the main measures in the bill:

Austerity measures:

– The income tax exemption is reduced to 5,600-5,700 euros from 8,600 euros to generate revenues of about 1.9 billion euros. The lower threshold will mean an increased tax burden of about 650 euros for taxpayers.

– Up to 18 percent cuts in main and supplementary pensions and freezing of benefits thereafter until 2022. The cuts will result in savings of 2.3 billion euros.

Asset sales

– Sale of stakes in railways, Thessaloniki port, Athens International Airport, Hellenic Petroleum and real estate assets to generate targeted privatization revenue of 2.15 billion euros this year and 2.07 billion euros in 2018.

– Main electricity producer Public Power Corp (PPC) must reduce its market share by 46 percentage points by the end of 2019 to reach a targeted 50 percent share.

Relief measures, contingent on meeting fiscal targets:

– Reduction of corporate tax rate to 26 percent from 29 percent.

– Ending a so-called solidarity tax for annual incomes up to 30,000 euros.

– Cut in the personal income tax rate to 20 percent from 22 percent.

– Slight reduction of the annual tax on real estate holding, provided it does not exceed 700 euros.

– Increased benefits for low income groups, including support for rental costs up to 1,000 euros annually, increased benefits for parents with children, subsidies for child care and lower costs for medicines.

[Reuters]