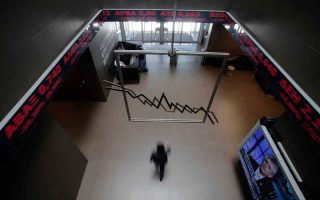

Athens ponders new bond issue

The Finance Ministry is seeking a window of opportunity for another bond issue, although for now it is sticking to a wait-and-see stance and, according to sources, has not yet even decided on the duration of the debt it may issue.

The dilemma is between a 10-year benchmark bond and a three-year paper, with interested buyers split down the middle, according to the messages reaching the ministry.

Before they even reach that point, the ministry and the Public Debt Management Agency will need to first decide if and when another issue should be made, and this will depend on two main factors, sources say.

The first would be the return of the seven-year bond yield to its February 8 issue level, 3.5 percent, or even lower, so that the investors who purchased it feel that their investment made sense. “We’re close, but not quite there,” a bond market professional commented, referring to the relative decline in Greek debt yields after their February highs, although they have not yet dropped to the level of last January.

The second factor would be the emergence of one or two pieces of good news. The anticipated positive results of the banks’ stress tests would fall into this category, but a bond market source noted that this has already been factored in to a great extent. He commented that Greece’s rating by the major agencies “is not a triple B but a single B,” showing how vulnerable the country is to international turmoil.

A genuinely good piece of news would be a positive development concerning the easing of the national debt, but that may not happen anytime soon. As a senior eurozone official said in Brussels on Tuesday, the target for an overall deal remains the June 21 Eurogroup.

The final decision on whether Greece will tap the markets again may be made on a political basis, too, as a successful issue would support the government’s “clean exit” narrative. However, there are no pressing needs for financing and any funds drawn from the markets would be used to build up the so-called cash buffer.