A half-pregnant IMF may fail to deliver

When the eurozone finance ministers last gathered in Brussels on May 22 to haggle over debt relief for Greece, Spain’s representative Luis de Guindos turned to the International Monetary Fund’s representative Poul Thomsen and, according to the leaked minutes of the meeting, said, “You cannot be half-pregnant.”

De Guindos was referring to the IMF’s position regarding the Greek program and the Fund being caught between satisfaction with the reforms agreed with Greece and disappointment with the eurozone’s commitment to debt relief.

The period since May 22 has provided an opportunity for this disparity to be addressed but it looks increasingly likely that the IMF will remain equivocal.

The idea put on the table in Brussels last month was that the IMF could provide its approval for the European lenders to make a new bailout disbursal to Greece but would refrain from providing any new funding of its own until further debt talks could take place in the months to come.

This was a convenient solution for the IMF in the sense that its board would not have to take a decision on whether to invest further in a program that has become the source of much friction within the organization. It was also handy for some of Greece’s European partners as it put off a politically sensitive decision regarding the detailing of medium- and long-term debt-easing measures for a few months, most likely until after the German elections in September.

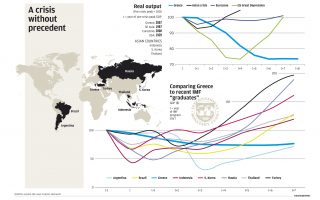

German Finance Minister Wolfgang Schaeuble’s reluctance to get embroiled in a complex negotiation with the Fund was emphasized when he recently blasted the IMF’s forecasts. The Fund sees Greece growing by an average of just 1 percent of GDP between now and 2060, which is much lower than European projections. Schaeuble suggested that these figures implied the Greek programs had been a waste of time and were far too pessimistic. According to the leaked minutes of the May 22 Eurogroup, the Austrian and Slovakian finance ministers made similar comments during the talks.

Greece was the one that stood to lose most from last month’s compromise as the absence of any further detail on debt restructuring would hamper its efforts to qualify for quantitative easing (QE) from the European Central Bank and to return to the international bond markets in the near future.

Finance Minister Euclid Tsakalotos declined the offer in the hope that a better one could be found before the next Eurogroup, due this Thursday. However, the indications over the past few days are that at least as far as the IMF is concerned, little is likely to change.

In an interview with German newspaper Handelsblatt published last Monday, IMF Managing Director Christine Lagarde indicated that the Fund is prepared to give European lenders more time to discuss debt relief.

“If the creditors are not yet at that stage where they can agree on and respect our assumptions, if it takes them more time to get there, we can acknowledge that and give them a bit more time,” Lagarde said. “So, we can be in a program, but the disbursement will only take place once debt relief is clearly articulated by the creditors,” she added.

This represents a significant shift in the organization’s position as it had given the impression for many months that the reforms it was demanding from Greece would have to be followed immediately by a decent level of clarity on debt restructuring so the board in Washington could make a final decision. This is what the Fund referred to as the “two legs” of the program.

Lagarde’s intervention was followed up on Thursday by IMF spokesperson Gerry Rice suggesting to journalists that the option of approving the program “in principle” is under consideration.

“I want to emphasize that the IMF’s primary object remains the full package of reforms plus debt relief,” he said. “If it proves impossible to reach agreement on the financing and the debt relief measures before mid-July… there is this option that would enable the IMF to approve the financing arrangement based on the policies that have been agreed but… while making any actual IMF disbursements contingent on creditors agreeing to the debt relief that’s necessary to ensure debt sustainability.”

Rice added that the IMF has used the “approval in principle” procedure almost 20 times in the past. “So, it’s a procedure that’s there, has been used, and can be used again,” he added, while stressing that no such decision has yet been put to the Fund’s board.

Earlier in the day, the Wall Street Journal published a story suggesting that such a decision by the IMF might go against its own guidelines. Rice, however, insisted that there is some flexibility on the matter as the bulk of previous such cases were in the 1980s, mostly involving Latin American countries suffering debt crises, and involved “unique modalities.”

“So, clearly we’ll draw upon what was done in the past, but will take into account the specific country circumstances were it to be applied today,” he said.

The IMF spokesman went on to point out that such a compromise would avoid the program continuing – in the Fund’s absence – without the debt relief “leg” and would prevent a “disorderly financial situation” in July, when Athens needs close to 7 billion euros of fresh funding to cover its debt repayments.

Although Lagarde and Rice could argue that they were simply setting out the options available, their comments suggested that the dice has been cast and it is unlikely there will be any way the IMF can fully commit to the program at this stage, perhaps ever.

There was a suggestion last week that the European creditors might push for the estimated growth impact of future EU investment projects in Greece to be factored in to the forecasts made by the institutions. This seems like clutching at straws as the IMF is unlikely to buckle under the pressure to produce higher growth forecasts after having its fingers burned during the first two Greek programs, after which the Fund’s chief economist at the time, Olivier Blanchard, admitted the fiscal multipliers which measure the impact austerity measures have on growth had been underestimated.

The IMF’s greatest value to the Greek government in these negotiations was that it provided the strongest advocacy for significant debt relief. As things stand in terms of divergent projections among the lenders, this no longer looks such a boon. Instead, Athens faces the possibility that a half-pregnant fund will not be such a powerful ally on Thursday.