Europe is proposing a border carbon tax. What is it and how will it work?

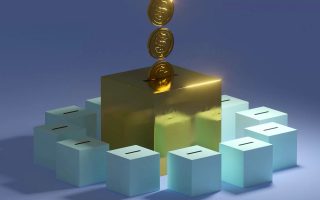

The European Union’s sweeping new plan to tackle climate change includes a proposal that if adopted would be the first of its kind: A carbon tariff on imports from countries that aren’t taking similarly aggressive steps to slash their own planet-warming greenhouse gas emissions.

Carbon border taxes, which have been debated for years, are intended to solve a basic problem. If a single country tries to impose policies to cut emissions domestically, it runs the risk that, for instance, its steel and cement factories will face higher costs and be at a disadvantage to foreign competitors with looser environmental rules. If steel and cement production shifts overseas as a result, that would undercut the climate policy, since those foreign factories would be emitting just as much or more carbon dioxide elsewhere.

In theory, a carbon border tax could help prevent that undercutting. If factories all over the world that wanted to sell steel, cement, aluminum or fertilizer to the EU had to pay a surcharge for the pollution they emit, they would have incentive to clean up their act too. Companies within Europe would have less incentive to shift operations overseas. And, if other countries adopted similar rules, that could put pressure on nations that are reluctant to curb their use of fossil fuels.

But skeptics say a carbon border tax could prove challenging to implement while angering Europe’s major trading partners, including Russia and China. The EU’s proposal is an early test case of whether this idea can succeed.

The idea could also spread. In the United States, Democrats on Wednesday proposed their own version of a tax on imports from countries that lack substantial climate policies as part of a $3.5 trillion budget plan. While that proposal is far less detailed than the EU’s plan, it’s a sign that climate policy is increasingly becoming interwoven in trade policy.

“It’s still an open question of whether border adjustments are the best way to spur global cooperation on climate change, or whether other approaches might work better,” said Brian Flannery, a visiting fellow at Resources for the Future, a think tank in Washington. “But now that Europe has a concrete proposal on the table, we can start having a serious discussion about how this might work in practice.”

How It Would Work

The details of the European Commission’s proposed “carbon border adjustment mechanism” is detailed in a 291-page document.

Right now, most industries in the EU are covered by a program that charges polluters for the carbon dioxide they emit. Known as the Emissions Trading System, the program sets a cap on overall emissions and steadily tightens that cap over time. Large polluters must procure permits for every ton of carbon dioxide they emit, and the number of permits dwindles over time, driving up the price. Currently, the price of those permits is nearly $60 per ton, giving European companies a strong incentive to cut emissions.

The EU is now proposing to tighten that cap further, while phasing out the number of free allowances it has long given to industries exposed to trade competition, like steel. The aim is to help slash the EU’s overall greenhouse gas emissions 55% below 1990 levels by 2030.

To meet that target, many of Europe’s industries may have to make drastic and costly changes. Steel producers like ArcelorMittal are experimenting with ways to use hydrogen instead of fossil fuels in their furnaces, though they warn that such upgrades could cost tens of billions of dollars.

That’s where the proposed carbon border tax would come in. Companies abroad that wanted to sell cement, iron, steel, aluminum, fertilizer or electricity to the EU would also be required to pay that price for each ton of carbon dioxide they emit in making their products. The idea would be to level the carbon playing field.

The border tax would not take effect until 2026. European officials are proposing a phase-in period where they would try to figure out how the border tax would work in practice, giving time for other countries to prepare.

The countries that would potentially be most affected include Russia, Turkey, China, Britain and Ukraine, which collectively export large amounts of fertilizer, iron, steel and aluminum to the European Union. The United States sells significantly less steel and aluminum to Europe, but could also see an impact.

Challenges Ahead

For one, companies hoping to sell certain goods to the European Union would need to monitor and verify the emissions associated with making their products. If countries can’t or won’t do that, the EU would impose its own price. Experts say that such verification is possible, but can be tricky.

What’s more, countries such as the United States, China and Russia have all objected to the border carbon tax, raising the prospect of retaliatory tariffs and trade wars. Countries may also try to mount challenges to the border adjustment at the World Trade Organization, although European officials say they are working to ensure the rules will withstand to legal objections. (Among other things, they are calling it an “adjustment” and not a “tax” for legal reasons.)

The European Union has backed down on similar proposals before. A decade ago, European officials wanted to charge foreign airlines taking off and landing in Europe for the carbon pollution they produce. But the EU scrapped the idea after heavy pressure from the United States and China.

European officials have left open the prospect that they could negotiate individual trade agreements with different countries that obviate the need for carbon tariffs, particularly with nations that are moving to adopt climate policies. But the details would need to be worked out.

The EU proposal still needs to be negotiated among the 27 member countries and the European Parliament before becoming law. While many EU companies, such as steel producers, support the idea of a border adjustment, they are less keen on losing their free allowances under the current carbon-pricing program, since that would force them to make more drastic changes to their businesses. That dispute could complicate domestic negotiations.

There is still a great deal of debate among experts over how effective the EU’s carbon border adjustment will ultimately be, said Johanna Lehne, a Brussels-based senior policy adviser at E3G, a research and advocacy group that works on climate policy. But, she said, officials saw the policy as vital for addressing fears that the EU’s climate policies could place the continent at an economic disadvantage.

“It sends a real signal that the EU is serious about trying to decarbonize these industrial sectors,” she said. “And they’re trying to find an answer to a lot of those domestic political concerns.”

[This article originally appeared in The New York Times.]