Precious knowledge we do not import from China

We have known for years now that an experiment of historic proportions is under way in China. Its focus is on finding a stable equilibrium between governance by one political party, the Chinese Communist Party (CCP), without elections, separation of powers etc, and the free market economy. In particular, it is an experiment where the dynamism of freedoms associated with the private ownership of the factors of production (see Li, et al, 2004), and hence of the market mechanism, are regulated by the government in order to bring the expected benefits to the Chinese citizens themselves, and China.

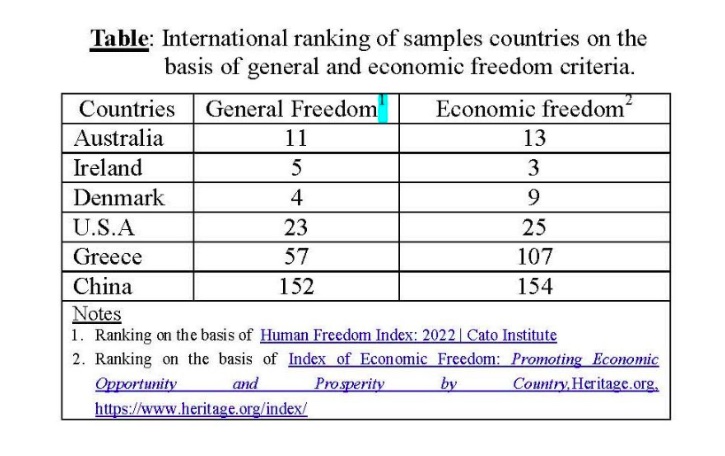

After four decades of adaptations to various conditions and parameters of the experiment, it is reasonable to wonder about the results. The answer depends on one’s evaluation criteria. Based on the values and culture of a liberal, the experiment has failed miserably because, for example, with the data in the table below, a regime of complete absence of general and economic freedom has prevailed in China.

On the other hand, by the standards of a strategic analyst in the West, the experiment has been crowned with extraordinary success because during the same period China managed to become the second world superpower after the USA. Last but not least, a third neutral observer, remembering what happened in the former Union of Soviet Socialist Republics (USSR) in 1991, will be aware that social experiments must have longevity, and four decades from the start of the experiment in China is not enough time, and only God knows what may happen there, for example, in the next 50 years.

We are not neutral. We understand that Western democracy is a successful and time-honored system of social and economic organization. We judge it severely for its many faults, but we expect that it will manage to overcome the crisis it is going through, as it has done many times since the years of the French and American revolutions. For this to happen again, there is only one way. To expand on the comparative advantages of the free way of life and contain or even shrink its disadvantages. So in order to contribute in this direction, we hereby thought to bring to the fore something that we discovered recently while researching the pension systems in the countries mentioned in the above table.

This has to do with the realization that as a country we import thousands of products from China except one that is extremely precious, which is actually offered to us completely free of charge. It is about the knowledge and the trust with which the Chinese people and the CCP – yes, the CCP – have looked since 1978 upon the domestic and international markets, in short the free market economy, to solve some of the big problems they face. But before we come to what we have learned by studying their bold pension reforms, the following preliminaries will be of great help in understanding its path.

“Plato Goes to China” is the title of a recent book written by Shadi Bartsch (2023) and published by Princeton University Press. The author takes a provocative look at Chinese politics and ideology, exploring Chinese readings of Plato, Aristotle, Thucydides and other ancient Greek writers. She shows how Chinese thinkers have dramatically recast the views of these giants of the Classical period to support the CCP’s political agenda, diagnose the ills of the West, and assert the superiority of China’s own Confucian classical tradition. According to Plato, virtue consists in propriety of conduct, and justice can only be achieved when both the ruling class and the general public practice this virtue. In China, consistent with the teachings of Confucius, Plato’s conception of the propriety of conduct, and thus of justice, was interpreted as a rule requiring that “every person should engage in the work for which he/she has been trained.” This conception of justice was embedded in everyday life and only those purposely trained for statecraft are authorized to mind such business as public administration and diplomacy, whereas the ordinary citizens should remain politically unconcerned in order to be freely mindful of their commercial or industrial stakes.

Thus, with the great majority of citizens convinced that the leadership’s decisions for the country stem from the wisdom of Plato and Confucius, and not the bitter experiences of the proclamations by Marx and Engels (1848), the CCP has legitimized itself in the public consciousness to introduce whatever reforms are needed to return China to world leadership, regardless of whether the nature of the reforms emanate from Adam Smith, Milton Friedman, or some other high priest of neoliberalism. With the above in mind, we can now turn to the proposition with reference to the reforms they have recently introduced in their pension system and contrast them with the ones in Greece.

In the above context, it has been observed through several years that the labor force in China is shrinking and aging fast, thus rendering the public pension system unsustainable. For example, a 2018 study by the Chinese Academy of Social Sciences showed that China’s state pension fund, which forms the backbone of the country’s state pension system, will run out of money by 2035. Considering this prospect in conjunction with the evidence showing that the supplementary pension coverage of workers through collective labor agreements and occupational funds is not sufficient, the problem had to be tackled in a radical manner. Thus, after a period of pilot experiences and learning, on April 21, 2022, the authorities issued the law “Opinions of the General Office of the State Council on Promoting the Development of Individual Pensions.” This laid down the foundations of the pension system through personal savings as a third pillar and stands as an exemplary milestone for China’s new era.

More specifically, with the said law, the State Council of China provides incentives to citizens to deposit savings into their own Individual Retirement Account (IRA) and invest them in financial products of their choice, in order to increase their retirement income. Under this legal framework, citizens can invest their savings in a range of financial products, use more options to build wealth, but with their own knowledge and responsibility concerning the risks involved, and at the same time contribute to the expansion of the sector of banks and financial companies. The launch of this third pillar of the pension system is the most important development in years as more than a billion citizens are encouraged to start their individual pension savings, and exercise their own diligence and responsibility to maximize their expected retirement income by benefiting from the opportunities that authorized fund providers offer in the open domestic and international financial markets.

In contrast to this amazing display of confidence by the CCP in the markets and the citizens to solve the big pension problem facing China, what are we doing here in Greece where we face the same, if not worse, pension problems? We have been drilling holes in the water because we have neither confidence in citizen-empowered solutions to social problems through open and competitive markets, nor the agility to learn from China’s CCP example. In 2021, the Greek government proceeded to establish the State Auxiliary Capitalization Fund (SACF) with two anti-market mandates. That is, first, the SACF was endowed with a monopoly to collect and manage the mandatory auxiliary contributions from new workers, and second, the state guaranteed that participants in the fund will never realize negative returns, irrespective of circumstances.

Moreover, after ignoring European Union directives for five years, a few weeks ago the Greek government introduced a reform by legislating that Occupational Insurance Funds (OIFs) can be established by multiple employers and businesses in the same or different industry, as long as there is an agreement by both employers as well as employees. Where the hole in the water is should be obvious. Having locked the auxiliary pension contributions of new workers into a tight legal monopoly, there is little or no extra residual saving to be directed to the OIFs. As a result, the statist convictions of the government have killed the prospect of OIFs in serving as a mechanism for accumulating significant amounts of savings and financing a healthy private economy.

To conclude, against all international evidence showing that market-driven solutions to thorny pension-associated problems are way better than the old-fashioned statist approaches, Greece, even though it ought to know well from its recent painful experiences, remains stubbornly anchored to choosing consistently suboptimal policies. Granting the SACF a monopoly on the management of compulsory supplementary pension contributions implies that workers in Greece will have neither the means not the interest to participate in OIFs or in other individual pension plans. Developed pension fund markets, including those of China under the CCP, allow workers the freedom to choose whether to join state or privately run pension funds. For it is widely known that in the long run, the development of robust and competitive financial markets leads to a win-win setup for both the citizens and the state.

George C. Bitros is emeritus professor of political economy at the Athens University of Economics. Steve Bakalis is former professor of economics at the University of Victoria, Australia. Sun Jin is professor of economics at the Central University of Finance and Economics, China.