‘Remarkable improvement’ in Greek economy

Respected economist sees local prospects as good, despite election uncertainty, but is concerned over global impact of geopolitical upheaval

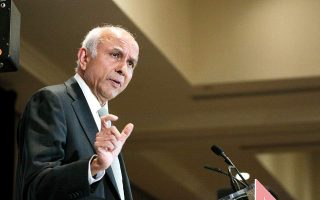

Nouriel Roubini can’t seem to shake the nickname “Dr Doom,” but his predictions are usually gloomy. This reputation was confirmed in a discussion with Kathimerini on the sidelines of the Delphi Economic Forum, where he was one of its pre-eminent guests.

But when it comes to the Greek economy in particular, the respected Turkish-born, Iranian-American economist and professor emeritus at the Stern School of Business of New York University has reason to be optimistic.

We’ve been hearing for a while about a correction coming in the market. Why isn’t it happening?

Well, a correction did occur last year. US and global equities were down: S&P by 15, Nasdaq by 30, and tech and growth stocks by more than that. Even bond prices fell sharply as yields were going higher and lots of other risky assets were down in value. There was a recovery this year, and I think it was initially explained by the central bank being ready to cut rates, inflation is falling, and mild recession to come. So there was the first wave that led to strengthening of the markets. Markets corrected a little bit at the beginning of the banking stresses in the US, but paradoxically now they’ve gone up and they’ve gone up because these banking stresses have led markets to expect that the Fed, but also the ECB, are going to stop raising rates sooner at lower levels and then they’re going to cut rates into the second half of the year. Central banks now tell us, “We’re going to raise rates and then keep them at this level for the rest of the year.” So there’s a bit of a disconnection between what markets believe and what the central banks are telling them. I think that some of the recent rise in the market is as central banks will be forced to cut rates in the second half and that’s good for the market.

There’s a lot of talk about whether the world is moving away from the dollar as the currency of reference. What’s your take on this?

Well, I wrote in February a long op-ed for the Financial Times on this topic. In summary, my view is we lived in a world where there was a unipolar global reserve currency regime, two-thirds plus of all reserves, transactions and so on were dollar-based. In a world that is becoming divided by geopolitics, having a multipolar global reserve currency regime is unlikely. What is more likely is that China is going to try to build the RMB as a pole for countries that are friends and allies of China. China, Russia, North Korea, Iran, maybe Pakistan and others. And for these countries, increasingly, the RMB may become means of payment, store of value, maybe even a unit of account. So we’ll have a bipolar system. It’s not as if the dollar disappears. Maybe the relative role of the dollar falls and the relative role of the RMB goes up. And even that is a process that takes decades. It’s not going to be overnight, but certainly the Chinese are going to go beyond the sphere of their own strict allies and go to countries like those in the Gulf and tell them: “Listen, why don’t they pay you in RMB for the oil I buy from you? Yes, I have some capital controls, but I don’t have controls on current account transactions. You’re buying lots of goods and services from me. You can use RMB to buy my goods and services.”

‘People worry about the eurozone and what’s going on in Italy or some other countries. But I think the risk in the eurozone might come from France’

Do you think there’s a deglobalization process going on and how do you think that’s going to affect stability?

Different people call it different words. De-globalization or a move away from free trade or some degree of protectionism. You know, it’s not 0 or 100%. We’re not going to have the hyper-globalization we had in the last 30 years. We’re not going to go, of course, back to autarchy. So the question is how much restriction there will be to trading goods and services and movement of capital, FDI investment and movement of labor and increasingly technology data and information. So it’s a matter of degree. They were going in that direction because even before the recent geopolitical factors, there was some backlash against hyper-globalization. Those left behind started to complain about it. And now there are also these national security considerations. So, we used to talk about free trade and then about fair trade, now about secure trade. We used to have offshoring, now there’s friend-shoring. We used to have just-in-time global supply chains, now we have China+1 just in case. And we’re emphasizing security over efficiency in the allocation of production and investment of labor and capital, in different regions of the world. How severe this process is going to be, deglobalization, fragmentation, balkanization of global supply chains, protectionism, restrictions of various types of trade, the extent of it depends very much on how severe some of these geopolitical tensions become. The honest answer is nobody knows. I’m concerned.

What’s your prognosis on Europe? A lot of people think that France is the litmus test: whether President Emmanuel Macron will succeed in pursuing certain reforms and surviving.

I’m supportive of his willingness to do reform. And certainly the pension reform is needed. France is aging like the rest of Europe. Life expectancy is higher. So the idea of going to retire at the age of 60, if not earlier, doesn’t make any sense. But the trouble is that he didn’t have a majority for it, so he went through a decree. This reform was highly unpopular, even more unpopular than what led to the Gilets Jaunes. And my worry is that while he’s doing the right thing, this reform is so unpopular in the substance and the way it was passed, that by next year, the European parliamentary elections that are usually typical protest vote, where people vote for other parties because they are angry with the establishment, Le Pen might do better than she did even last time around. If that happens, you could have a situation in which people say that she may win the next presidential elections. Then the spreads for France start to widen and there might even be contagion to some of the periphery. And with a widening of the spreads, then Macron is going to be forced a couple of years before the elections to fiscal austerity, the same way in which Italy or Greece or the UK was forced to do so. And that’s going to make him even more unpopular. He cannot run for a third term. There’s not an obvious candidate for the center, center-right. And probably Le Pen[’s party are] going to slightly moderate their views at the margin to win those election. And you may end up with Le Pen winning the next France presidential elections. And Le Pen, as of today, is much more radical than Meloni in Italy. People worry about the eurozone and what’s going on in Italy or some other countries. But I think the risk in the eurozone might come from France. So that’s actually the thing I’m most worried about. And who can beat Le Pen? I think at that point Lagarde is going to run.

And I understand that you’re fairly optimistic about Greece, right?

I am. There’s been quite a remarkable improvement in the economic overall fortune of the country. The data itself on growth last year, even this year, is going to be lower, but better than the eurozone average. Certainly compared to the years of the civil crisis there has been a massive turnaround of what’s going on in the economy by a wide range of indicators, starting with economic growth. So it’s been a success story definitely in the last few years. Of course, there are now political uncertainties coming from your upcoming elections and who’s going to win one election or two or more. And then what’s going to be the economic policy, whether New Democracy is going to win again, and the continuation of the kind of macro and economic reform that occurred in the last four years or not. But I guess the markets are not reacting to that uncertainty by widening the spreads for the bonds. That means that probably there is a sense that some of this renewed economic stability is quite grounded regardless of the fact that there’ll be some political and therefore policy uncertainty.

To turn to Turkey, do you think an IMF program is inevitable after the election?

Well, it depends on who’s winning. If the opposition were to win, then they’ll do a program of macroeconomic stabilization, given the size of the current account deficit and given the net reserves of the central bank. The net of what they borrowed looks like it’s negative 60 billion. They will definitely need a pretty large IMF program to smooth the transition to more stable monetary and fiscal policies. So I think that if the opposition wins, yes, an IMF program will become inevitable because they would want to do the right thing, but without financing – and there is not much private sector financing – it is going to become very hard to do. So even with an IMF program, it’s going to be very bumpy. If instead Erdogan were to be re-elected, his current policies are highly heterodox and there’s no way that if he continues those heterodox policies the IMF would accept giving Turkey any money for those heterodox policies. He will have to do a U-turn and go from macroeconomic heterodoxy to orthodoxy. He’s bashing even now the interest rate lobby and there’s this strange view that higher interest rates mean more inflation, and lower interest rates mean lower inflation. It’s nonsense. So I’m not sure if he’ll be accepting the kind of humiliation that will come from having to have somebody essentially monitoring very strictly monetary, fiscal, structural policies and so on. He may be forced to, because if he doesn’t, eventually there is a currency and a financial crisis. So maybe only after the crisis, he’s going to accept to name somebody who’s even more orthodox to run the economy. Some people have suggested that this previous finance minister and deputy prime minister Mehmet Simsek, who is highly reputable, after the election, if Erdogan accepts a serious program of economic adjustment, may consider coming. And then maybe Erdogan can be convinced to get an IMF program. But, he’s a very proud man and it’s anybody’s guess what economic policy is going to be if he were to be re-elected.

Mega-threats and tidal waves in the banking system

Let me ask you about the concept of mega-threats – the things that could really destabilize everything.

In my recent book, I talk nothing but economic, monetary and financial threats, but also social, political, geopolitical, environmental, health and technological that interact with the economic ones. They can lead us to be in a very bad place. I use the term mega-threats, but for example, the Financial Times this year chose as one of the words of the year, the term holy crisis. Same idea of economic and non-economic factors interacting with each other. I was last December on stage with Kristalina Georgieva, the MD of the IMF, presenting my book and discussing it with her. She wrote this speech about the confluence of calamities, that alliteration confluence of calamities like we’ve not seen since World War II. Christine Lagarde, head of the ECB, has spoken about the perma-crisis. In January in Davos, they published their yearly World Global Risk report that was all about risk threats and polycrises. Same idea, economic and non-economic factors. And now where there is the geopolitical depression, the risk of war, cold wars, and then hot wars between great powers, the risk of climate change, the risk of more persistent and more virulent future pandemics, the risk that even AI can increase the economic pie, may lead to permanent technological unemployment, may lead to a rise in income and wealth inequality. Under some scenario, the political manifestation of all this malaise, rising income and wealth inequality, middle class squeezed, young people feeling that they’re going to be worse off than their parents, whole groups of society feeling they’re left behind, is now some degree of backlash against liberal democracy and democratic capitalism. And you see now extreme parties of the radical populist right and/or left – depending on the country – becoming more popular and in some cases coming to power. But as I point out in the epilogue of the book, right now we’re not addressing any of these problems and they’re accumulating and feeding on each other, so I’m worried about it.

How about the banking crisis that started with Credit Suisse? Are there any skeletons hidden in the regional banks in the US?

Some of the regional banks are still under a meaningful amount of pressure. One of them is First Republic. I think the business model of many of these regional banks is challenged today because the value of any assets has gone down, not just securities, but also the value of their loan portfolio. Because they lend for mortgages and other loans, where interest rates are much lower. A larger fraction of the deposits are uninsured. And there has been a run and the average bank was essentially giving depositors barely 50 basis points, when now short-term interest rates are 5%. Why would you want to put your money at almost zero in the bank so you can earn in a money market fund that is, say, 5%? So there’s been also that. I think people are moving out of those regional banks for two reasons. One, uninsured deposits are risky. Two, they can earn more. So I think that the problems of some of these regional banks are not over, point number one. Point number two, they will become much more cautious in terms of lending. There’ll be a credit crunch. And many of these banks lend to households, to small and medium-sized enterprises, and they do a lot of the lending for commercial real estate. And there are already estimates that the credit crunch caused by these banking stresses is going to affect the US economic growth by at least 50 basis points this year. So suppose that the credit crunch is slightly more severe than that. And suppose that then the economy ends in a recession. And the baseline of the Fed economists is that the US is going to enter a mild recession in the second half of the year. If this happens, the default rates are going to rise. Nonperforming loans of the banks are going to rise. They’re going to move from market and duration risk to credit risk. And then there is a risk that the credit crunch makes the economic downturn more severe, which will lead to more defaults, and then you can end up in a bad place for the economy, for the financial markets and for the banks.