Why Greece’s crisis has broken all previous records

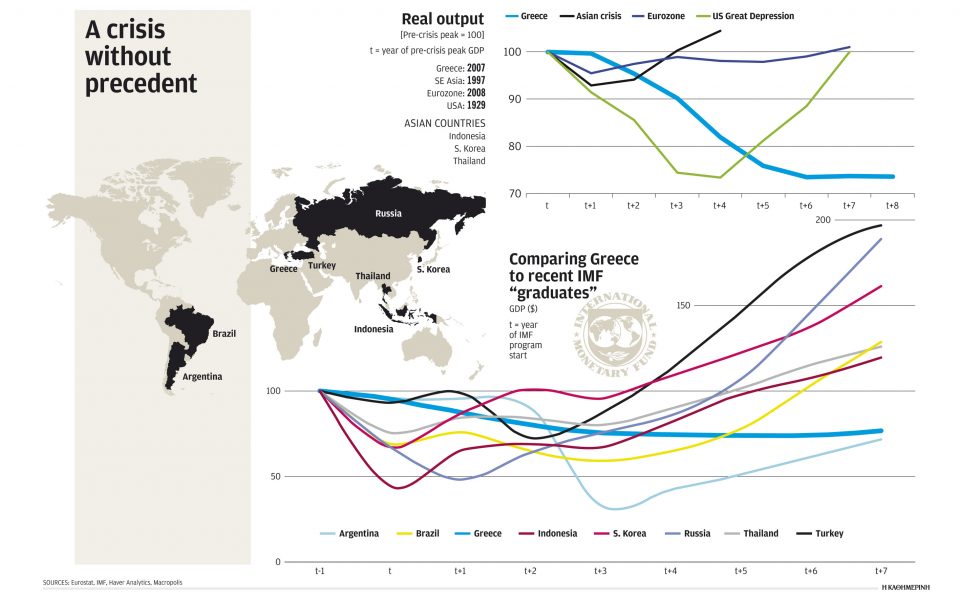

How unique is the Greek crisis? Two charts tell the tragic tale. The first – from the International Monetary Fund’s recent Article IV report on Greece – compares four major economic crises that took place in the developed world in the last 100 years: the Great Depression in the United States, the Asian financial crisis of the late 1990s, the eurozone recession and Greece’s long collapse.

Greece’s performance is by far the worse.

The East Asian countries caught in the hurricane of 1997-8 returned to pre-crisis real GDP within three years. The eurozone needed six years, and today its real GDP is only 2 percent higher than the pre-crisis high point. The output of the US economy had shrunk by a quarter three years after the Wall Street Crash of 1929, but by 1936 it had recovered to pre-crisis levels.

The Greek economy contracted by 26 percent in real terms between 2007 and 2013, and at the end of 2016 – nine years after the start of its own Great Depression – it remained stuck at the bottom.

Seven-year glitch

The second chart, from the analysis service Macropolis, compares the performance of eight countries that have sought assistance from the IMF since 1997 seven years after the start of their programs. The Fund’s best student was Turkey, which doubled its GDP in real terms between 2000 and 2007. Russia was a close second, largely thanks to growth fueled by climbing oil and gas prices. South Korea comes next, with growth well above 50 percent from its baseline year, while Indonesia, Brazil and Thailand are hovering around 25 percent.

The only countries which remained below their pre-crisis GDP levels seven years after seeking the Fund’s assistance are Argentina (in the aftermath of the 1998-2002 crisis) and Greece. At its low point, three years into its crisis, Argentina’s dollar-denominated GDP – largely because of the devaluation of the peso after the abolition of convertibility – had fallen by two-thirds compared to pre-crisis highs. At the seven-year mark, Argentina, unlike Greece, was experiencing a robust recovery.

Focusing on the comparison with the Great Depression in the United States, US unemployment peaked in May 1933 at 26 percent, to be cut by more than half by the end of 1936. In Greece it reached 28 percent in July 2013, and has since fallen to 23 percent. The Dow Jones Industrial index lost 85 percent of its value between August 1929 and May 1932, but it rose fourfold in the three-and-a-half years to the end of 1936 (another 23 years would pass, however, before it got back to pre-crisis levels).

The general index of the Athens Stock Exchange also nosedived by 85 percent between October of 2007 and June 2012. To date, it has only recovered by about 30 percent.

Gikas Hardouvelis, a professor at the University of Piraeus and a former finance minister, notes that “the Greek crisis, unlike the American one, is not a single crisis, but three: the global meltdown of 2008-09, the initial phase of the Greek crisis between 2010 and 2013 and the second phase, starting in 2015.” The fall of GDP in Greece, he explains, was not as sharp as in the US, because “we did not have a banking crisis in 2008 and because the funds borrowed from our partners in 2010 prevented a default.”

The length of the Greek crisis, according to Hardouvelis, is in part attributable to the fact that “our only macroeconomic weapon was internal devaluation, and we never owned the adjustment programs.” In the US, by contrast, “they had control over monetary and exchange rate policy,” and they adopted significant reforms (social security, unemployment insurance, the Glass-Steagall Act, deposit insurance) which contributed to social cohesion and financial stability. He also points out, however, that the absence of a pre-existing welfare state in the 1930s meant that similar rates of recession and unemployment translated into much greater suffering then compared with today.

The case of Argentina

The comparison with Argentina is also instructive. Three things are worth noting. First of all, even though the exit from the fixed exchange rate regime was, for some Argentina-watchers, a necessary condition for the recovery of the economy, the precipitous devaluation it caused led to a fall of dollar-denominated GDP by 64 percent in a single year. This reflected a massive loss of purchasing power that will also hit Greek depositors in the case of a Greek exit from the euro.

Secondly, as Domingo Cavallo, the country’s economy minister between 1991 and 1996 and the architect of the convertibility policy, tells Kathimerini, Argentina entered its crisis with a public-debt-to-GDP ratio of 50 percent and a primary deficit of only 1 percent – numbers much better than Greece’s in 2009.

The third point concerns the significant contribution of increased exports, especially farm products, to the recovery between 2003 and 2005.

“The key for the quick recovery of the economy was the existence of a well-capitalized and efficient export sector, which was not restricted only to commodities,” Cavallo says.

The former minister claims that the continuation of the fixed exchange rate regime would not have undermined the recovery – it would only have rid it of its inflationary character.

In any case, the comparatively less propitious international environment and the lackluster performance of the Greek export sector lead to the conclusion that it would be hard for Greece to mimic Argentina’s achievement even if it were to regain control of its monetary policy and its exchange rate.

Disastrous combination

According to Ashoka Mody, a visiting professor at Princeton University and former high-ranking IMF official, the creditors’ key mistake in Greece was not restructuring the country’s debt in May 2010. This led to “extraordinary levels of austerity,” whose consequences were multiplied, he says, because the creditors persisted in denying their mistake.

But Mody is also very critical of Greece. “It’s not just that Greek governments lived beyond their means for a quarter of a century – they repeatedly lied about it and took advantage of the incompetence of the Commission to monitor, much less to enforce, fiscal discipline,” he says.

Even today, after all that has happened, “the government retains its ties with the old networks of corruption, and persecutes and vilifies the man who tried to tell the truth about Greece’s statistics.”

“The combination of catastrophically bad policy imposed on Greece and the country’s unwillingness to change its ways – the ones that got it into trouble – have led to a economic and social collapse of historical dimensions,” he concludes.

Also read: