Projects interconnecting energy and geopolitics need to have a market

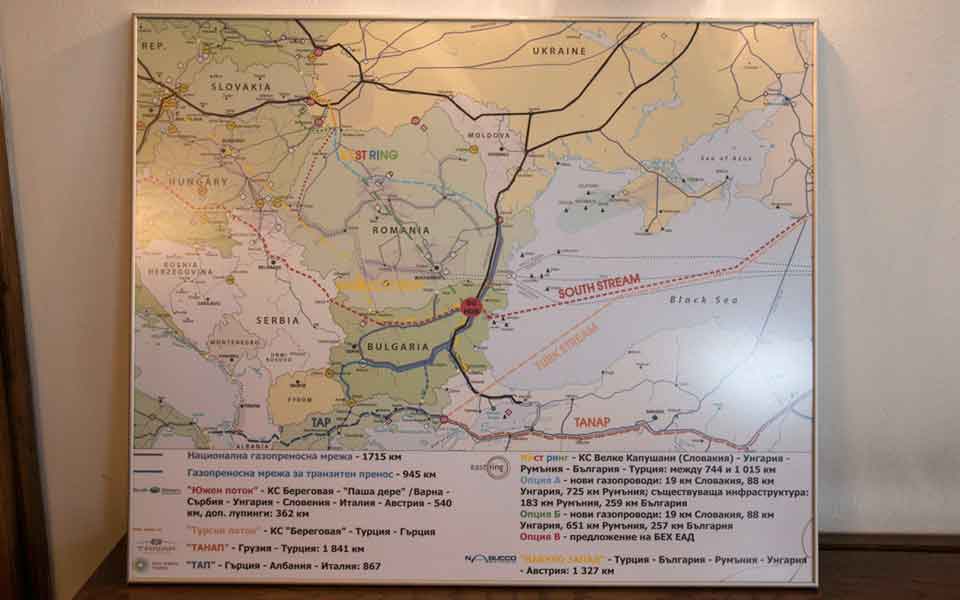

A host of energy projects, such as TAP, IGB, Turkish Stream and others are under way or in the preparation phase in the Balkans and Black Sea region, and Greece must make the most of them to upgrade its status to energy hub, notes Dr Theodoros Tsakiris, assistant professor of energy policy and geopolitics at the University of Nicosia in Cyprus.

He is taking part in the Balkans & Black Sea Cooperation Forum that opens on Thursday in Serres during a period of frantic planning and project implementation as regards a number of interconnection pipelines and energy networks across the region, with multiple geopolitical and financial implications. He cautions that interconnection projects have to make financial sense to be feasible regardless of their political significance and highlights several projects of energy source diversification that will free the region of various dependencies.

Speaking to Kathimerini English Edition, Tsakiris – also director of the Energy Program at the ELIAMEP think tank in Athens – offers an overview of the current key issues and challenges that lie ahead regarding energy relations in the region. He will be moderating Thursday’s discussion on energy interconnectivity at the Forum.

How significant is the Trans Adriatic Pipeline for Greece and the Balkans?

The TAP project is of particular significance to European energy security at a time when the European Union’s net import gas dependence has, according to the latest statistics by BP’s Statistical Review of World Energy (2016), risen more rapidly than anyone could have anticipated. In 2013 the European Commission projected that the EU’s gas import dependence would reach 65 percent by 2020 and in 2015 it had already reached 75 percent, due to the rapid decline in the EU’s domestic gas production and the nonexistence of unconventional gas production by shale or tight gas formations.

At the same time, the drastic drop in liquefied natural gas (LNG) imports, combined with the Arab revolutions of 2011 that essentially eliminated gas exports from Egypt and Libya, means that the diversification of the EU’s gas supply security has also measurably decreased while our import dependence increased in areas of high political risk or high transit risk, as is the case with Ukraine. TAP provides an answer to both challenges.

It brings new gas through a new route and is scalable to the extent of doubling its initial export capacity, estimated at 10 billion cubic meters per year. Although 10-20 bcm/y does not drastically ameliorate European gas security conditions, given that we cover 33 percent of our demand from Russia (that is 135 bcm/y in 2015), it makes a big difference for countries such as Greece and Bulgaria that have each contracted to import 1 bcm/y via TAP. One bcm/y of Shah Deniz gas is around 20-25 percent of Greek demand and more than a third of Bulgarian demand in 2020.

Do you believe that Athens, Sofia and Brussels are indeed committed to promoting the Interconnector Greece-Bulgaria (IGB) gas pipeline?

This is primarily a Bulgarian problem. Sofia has moved back and forth on this issue so many times that it is becoming difficult to remember them. I believe though that the recent thaw in Gazprom’s relations with the European Commission, in conjunction with the realization that the construction of TAP is now irreversible, will help to resolve the impasse. Bulgaria needs to understand that there is no way other than connecting IGB with TAP for Sofia to import Azeri gas and limit its complete dependence on Russia.

What is the importance of the possible implementation of the energy (gas and electricity) interconnection of Israel, Cyprus and Crete for Greece, Cyprus and the EU?

The realization of the concepts you are referring to would have a major positive geostrategic effect for Greece and Cyprus, elevating both states as significant transit states for the transportation of energy to Europe. But, under the current market conditions, taking into account the limited export potential of the Aphrodite gas field off Cyprus, neither of those projects is likely to mature until after the early 2020s. The real contribution to the EU’s energy security would be the discovery of more fields that could really revolutionize the region and make Cyprus a true exporter to the EU and beyond.

More importantly, the EuroAsia Interconnector electricity project does not have a market in Greece and cannot be utilized by Greece to link the country’s continental electricity system with Crete, which would in turn free the island’s renewable electricity production capacity currently estimated (ad minimum) at 2 gigawatts. Unless non-Greek markets are found to absorb EuroAsia’s electricity load, the project will be redundant because it cannot be used by Greece’s power grid operator ADMIE or Greek energy planners to resolve the problem of Crete’s electricity isolation, which costs Greek consumers around 400 million euros per year.

Could Greece reap greater benefits from hydrocarbon survey licensing than what the Republic of Cyprus collects?

Greece is several years behind Cyprus regarding the speed at which the permitting process is completed, and in contrast to Cyprus there has been no discovery of hydrocarbons – as has been the case since 2011 – that really galvanizes the interest of the international oil companies (IOCs). This is an injustice, since Greece has a much more competitive fiscal regime for attracting IOCs compared to Cyprus. What it does not have is the credibility that the regime is not going to change. Moreover, in Greece it takes up to 30 months to complete a tendering round for hydrocarbons licensing. In Cyprus it is completed in less than 10 months.

First it was South Stream, now Turkish Stream… How feasible can the upgrading of the energy interconnection between Russia and Turkey be in the current political climate, and what would this mean for Greece?

There are two lines of Turkish Stream. Turkish Stream 1 is already a mature project that is expected to begin construction within 2017. It will cross the Black Sea and reach the outskirts of Istanbul to completely eliminate Turkish transit dependence on Ukraine. There is no question this pipeline will be constructed. Last month Gazprom even commissioned a Swiss-based company to construct the underwater part of the pipeline.

Turkish Stream 2 is another story. It is a projected transit pipeline that needs to offer Greece and maybe Bulgaria the same positive effects it has offered Germany and Turkey, namely the elimination of the transit risk that is today the utilization of Ukraine’s transit route. Its realization would depend on whether Gazprom would be able to use Phase 2 of TAP’s transit capacity of 10 bcm/y or on whether a Russian-European consortium would decide to carry the cost of 5-6 billion euros to build a land pipeline from the Greek-Turkish border to Igoumenitsa and then construct the Poseidon pipeline linking Greece to Italy.

Also read:

A new think tank for the Balkans and Black Sea

Chinese ambitions could transform Southeastern Europe into a key area