Britons eye Greek properties

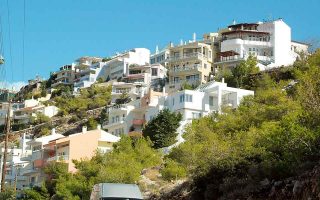

The islands of the Cyclades, Lefkada and Cephalonia in the Ionian Sea, as well as the capital Athens and the nearby islands (e.g. Spetses, Hydra etc) are today the most expensive areas for investing in the property market across Greece. Nevertheless investment interest in them from abroad remains particularly strong and looks set to surge as soon as the health crisis is over.

According to a survey by British group Astons, which specializes in investor migration issues, the Greek market remains among the top picks for foreign – particularly British – investors, as even the most pricy regions appear particularly affordable compared to rival destinations abroad.

For instance, per the Astons data, the average house price regarding sales in the Cyclades came to 222,348 euros in 2020, posting an increase of about 6% from the average price of €210,000 in 2019. Still, that’s 85% below the average price of a house in some areas in central London such as Kensington or Chelsea.

House prices on Lefkada posted 8.7% annual growth last year, averaging at €165,000, against €151,790 at end-2019. In Athens – the fourth most expensive area in the country – the price of residential properties averaged at €157,415, up 3% on a yearly basis.

Across the country the average sale price amounted to €131,030, posting a 2.7% rise from 2019, when the mean price stood at €127,600.

The lowest prices are to be found in Florina, northwestern Greece, averaging at €43,176, (down 4.3%), while in Kilkis, central Macedonia, despite last year’s 20% jump the median price came to just €50,400. Among the other low-price cities are Karditsa (€51,576), Kastoria (€56,000) and Serres (€56,868).

Astons notes that the Cyclades will remain the focus of foreign investors, especially those with significant income, as they prioritize quality of life when buying a property, even if that is at the expense of returns.

The British group says Greece offers an excellent climate and significantly lower house prices compared to the UK.