ENFIA cuts for most owners

Taxpayers with assets in areas with an objective value hike up to 20% will see dues drop

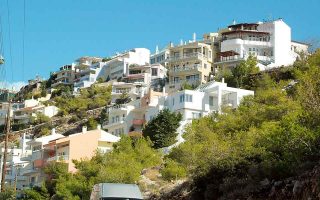

The taxable value of Greek citizens’ real estate property is set to rise by at least 100 billion euros next year, topping €700 billion in total.

The inclusion of about 3,500 regions to the system of automatic calculations of property prices used for tax purposes (known as “objective values”) will mean the coverage of about 98% of the population, followed by the remaining 2% later in 2022. That will be the first time the Single Property Tax (ENFIA) will be imposed on such an expanded tax base.

Based on the current ENFIA calculation rates, individual owners and companies would have to pay an additional €3 billion in main and supplementary property taxes. However, as the collection target for next year will remain at around €2.6 billion, the Finance Ministry will have six months to decide which way it will redistribute the tax load of €350-400 million.

The ministry will use the modification of the ENFIA calculation rates, the change to the calculation brackets for the supplementary tax (imposed on large ownerships) and the adjustment of the discount rates introduced in 2019, so as to allow a fairer distribution of the tax burden on owners.

Millions of taxpayers, and even property owners in areas where zone rates will go up 10%-20%, will be asked to pay less for their ENFIA in 2022. On the other hand, owners in areas where the objective values will increase considerably (the list will introduce hikes up to 40%) will have to pay more in 2022 than this and last year.

The valuation of Greeks’ real estate assets will be carried out on the basis of the new objective values the independent Authority for Public Revenue will publish probably on Monday.

The highest property taxable value ever recorded will allow the ministry to implement in full the ruling party’s pledge before the last election about an average decline of ENFIA by 30%. Already dues have declined by 22% from 2019 and discount rates are set to increase in 2022, bringing the average drop of the ENFIA obligations to about 30%.