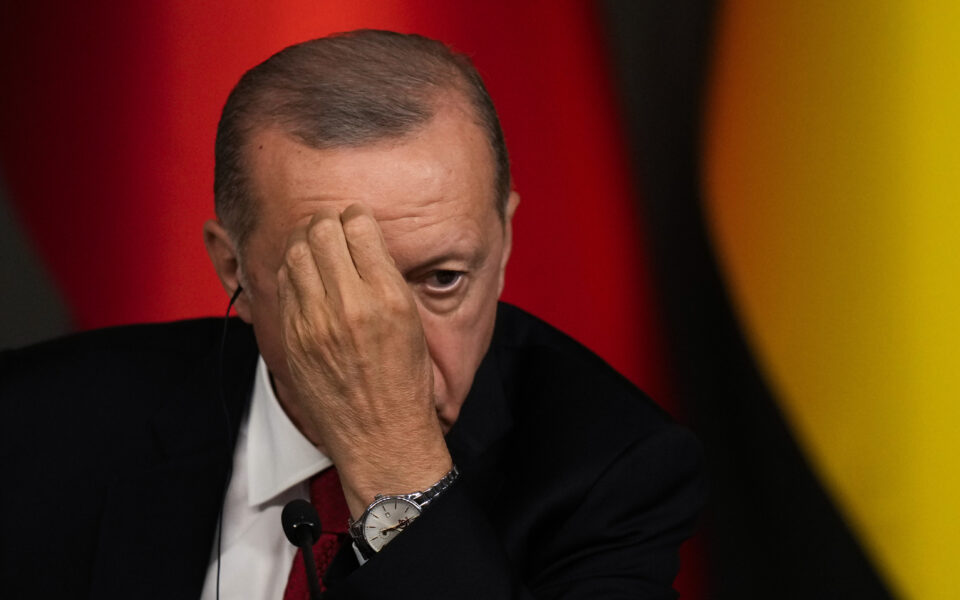

Erdogan appoints three deputy governors to central bank

Turkish President Tayyip Erdogan named three deputy governors to the central bank, the country’s official gazette said on Friday, a day after the bank vowed to continue gradual monetary tightening and raised its end-2023 inflation forecast.

Osman Cevdet Akcay, Fatih Karahan and Hatice Karahan were appointed as deputy central bank governors, replacing three predecessors, the statement showed.

Fatih Karahan, who held economist positions in the Federal Reserve Bank of New York for almost a decade, most recently worked for Amazon as a principal economist, according to his LinkedIn profile.

Akcay is an economist who used to work at Turkish lender Yapi Kredi and Hatice Karahan is an academic and a chief economic adviser to the president.

Tim Ash, a strategist at BlueBay Asset Management, said the appointment of the three represented a “180 degree turn” by Erdogan as they replaced less orthodox thinkers.

“Cevdet is a superb economist and clear thinker. Hatice is excellent as well – a rational, orthodox thinker. Fatih Karahan, ex-NY Fed. Superb hires,” Ash said.

The lira stood at 26.9560 against the dollar on Friday morning, unchanged from Thursday’s closing level. It has lost 30% of its value this year.

Inflation forecast surges

The appointments came after the central bank, under new Governor Hafize Gaye Erkan, reversed course and tightened policy in the last two months following years of rate cuts and a simmering cost-of-living crisis.

On Thursday, Turkey’s central bank raised its end-2023 inflation forecast sharply to 58% and said it would continue monetary tightening. Annual inflation stood at 38.2% in June.

In what was seen as a pivot to economic orthodoxy, Erdogan appointed Mehmet Simsek as finance minister and Erkan as central bank governor after his re-election in May. Erdogan holds the unorthodox view that high interest rates cause inflation.

Since Erkan’s appointment, the central bank has hiked its policy rate by 900 basis points to 17.5% in two meetings, but the pace of tightening has remained below market expectations.

Erkan pitched a comprehensive monetary policy in her first formal address to the media on Thursday while her acknowledgment of stark inflation pressures was welcomed by foreign investors.

Economists expect the policy rate to rise further to 25% by year-end, still leaving real rates negative. They warn that Erdogan’s influence over the central bank limits how far it can go in tightening policy.

Erdogan removed the previous deputy governors Emrah Sener, Taha Cakmak and Mustafa Duman, Friday’s statement said. [Reuters]