Quarterly national accounts: Income distribution

This Note for Discussion looks at the national accounts from the income side. It asks the question: with the goods and services produced and value added having been generated, who gets paid for all this work; how is value added distributed as income? Let’s have a look.

There are two key sectors in any economy, the private and the public. Roughly speaking, the private sector produces and the public administers and regulates. The private sector defends private interests, the public sector needs to defend the public interest, or the public good, as it is often called. Sometimes the public sector loses its way and gets in the business of defending specific private interest as well. This is a road to misery and goes to the problem of capture and social distress. Voters are well advised to watch like a hawk at all times whose interests the political system is representing – it should always be the public interest.

But let us assume that in our harmonious country the private sector produces and the public sector administers and regulates. Both need money to do so; both need some income to compensate them for their efforts. Where does the money come from? The money is the counterpart of production – the combined value added that is produced in the private sector. The government takes a small share of this value added as well. There is justification for this in the sense that good administration and regulation of the public good actually makes the private sector more productive. A good public sector adds to productivity in an indirect way, say by addressing externalities, keeping the peace, administering justice, etc. A bad public sector works in the opposite direction.

In turn, the private sector has two key agents operating in the productive process: workers and investors. Workers provide labor services in production – entities would not be able to operate without the factor labor – and investors provide capital. There are hybrids of this model, where workers may own factories and are themselves taking on the function of investors, but the economic essence can still be distinguished. The compensation for work is called “compensation of employees” and the national accounts keeps track of how much is paid to workers – the factor labor (L). The compensation for investors is called profits or “operating surplus,” which in turn could be described as the return to the factor capital (K). The operating surplus is what is left over after paying labor and all other input costs in producing goods and services.

But not quite, because then the government shows up and takes (taxes) a small share of the value added as well. This comes out of value added that would otherwise have been distributed as the labor and capital share of national income. Because the government plays an indirect role in fostering production of goods and services, we call the income derived from this activity “indirect taxes minus subsidies” (the subsidies being indirect income that the government sometimes distributes back to labor and/or capital). “Direct taxes” refers to revenue that the government captures directly from wages, salaries (i.e. compensation of employees) and companies (i.e. operating surplus). This results in redistribution of value added after it has been distributed to labor and capital, not a charge on value added itself before its primary distribution. To see who gets what after all redistribution is done via the government is the study of the “secondary (and even tertiary) distribution of income.” Of course, this is a hot topic as well because it involves the power of the political system to spread the fruits of the country’s inventiveness and competitiveness to all families and all companies and other actors. The power of the purse is what sometimes fascinates politicians more than the public interest itself.

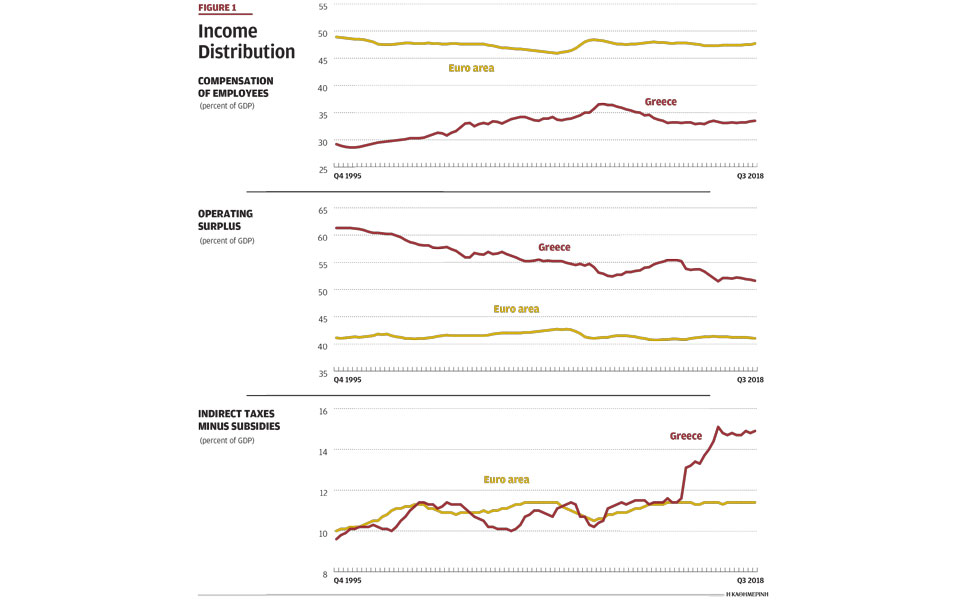

This note is about the original distribution of value added. Figure 1 provides the results as presented in the national accounts data from the Hellenic Statistical Authority (ELSTAT) from 1995 Q1 through 2018 Q3. Once again, I have compared with the same concepts in the euro area (Eurostat data) to see how Greece sits relative to its partner countries. Some observations may be made:

– Compensation of employees out of value added in Greece is much lower than in the eurozone, and operating surplus in Greece is much higher than in the eurozone.

– There may be bad and good reasons for this, but one problem is often noted in Greece: many people register as “self-employed” and their income is registered as operating surplus even though in most countries a good chunk of their income would be registered as compensation of employees. Thus, the statistics themselves are troubled because part of the “operating surplus” is really labor income and not capital income.

– Very gradually, Greece is trending toward becoming like the average eurozone countries. Compensation of employees is slowly increasing to the eurozone benchmark, interrupted (temporarily?) by the crisis; and operating surplus is gradually descending to the eurozone benchmark, interrupted (temporarily?) by the crisis.

– More recently, however, the real standout activity is in the government’s claim on value added. Since 2015, indirect taxes minus subsidies have jumped by 3.5 percentage points of GDP, and are now well ahead of the eurozone benchmark. This is a remarkable development, and since the compensation of employees has remained relatively constant lately, this income out of value added has been taken out of operating surplus (which had risen during the crisis before 2015).

I wish to take pains not to jump to conclusions. The point is to record reality first, to the extent we can actually observe it. Then we need to know what is causing this reality to move as we see it, before we draw conclusions. It is of course the government that needs to explain what is going on, in its dialogue with the public, because this reflects government decisions and political behavior. I can’t refrain from asking some speculative questions, however:

– Is the recent improvement in the fiscal accounts a reflection of large increases in indirect taxation, as suggested by these data?

– Is government policy saying “we have been living beyond our means in the past and borrowed too much to sustain this standard of consumption. Now we need to tax our standard of consumption to pay back the debt and return the country to a more sustainable path”?

– Is this large increase in indirect taxation sustainable from a socio-economic point of view?

– In the previous Note for Discussion, we saw that Greece has a much higher rate of consumption relative to the eurozone benchmark and saving is insufficient to support strong domestic investment. Therefore, is this indirect taxation an incidence on consumption, and a support for government saving, that is well justified to help bring the country into a better macroeconomic balance?

– But since we know that households at the lower income strata of society are spending a larger share of their income on consumption, are these households inadvertently relatively negatively affected by the boost in indirect taxation? Are the broadest shoulders in Greece, who presumably have also benefited the most from the debt boom, carrying the biggest burden to pay back the debt?

I don’t know the detailed answers to these questions, but these are considerations that deserve to be discussed and researched. I repeat myself that, foremost, the government needs to offer perspective on these questions, because it is the government that guides this process. It would also be very helpful if the global institutions with their impressive expertise, including the European Commission, Eurostat, the IMF, the OECD and others, could keep an eye on the big picture to help explain what is going on with the economy and whether any of this is “optimal” policy. No, Greece does not need more debt; but, yes, Greece does need help from sound and open technical analysis and advice. There should be no secrets and we should not get bogged down in “confidential” deliberations. Greece, in the end, needs to make its own decisions and thus the public needs to know, and has a right to know, what is happening. What we see in the national accounts raises a number of questions that deserve answers from the government.

Bob Traa is an independent economist. This is the 17th in a series of articles by him for Kathimerini titled “Notes for Discussion – Essays on the Greek Macroeconomy.”