Finance Ministry beats local authorities’ reluctance

Objective values determined in areas outside the system despite municipalities’ inactivity

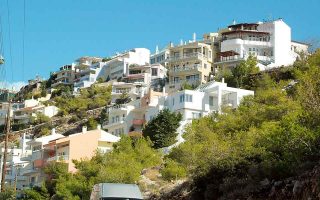

The agencies of the Finance Ministry beat the reluctance of local authorities and managed to obtain details about the market prices and zone details of numerous areas around the country so as to calculate the taxable rates, known as “objective values” and announced a week ago.

The ministry’s system of objective value determination will as of 2022 cover 98% of the Greek population, up from 85% today, according to the data released last Monday. That was done through the addition of more than 3,600 areas into the system, with 40% of them posting an average zone rate rise of 26%.

The competent agencies started to seek out the areas that had been out off the system through the municipal authorities. They had to register on a special platform for the new zones to be drafted. However, only 10% of municipalities responded to the ministry’s call.

Seven ministry officials had to solve the problem and identify the areas and settlements off the property tax grid. They then had to identify which of those areas had properties that had to be taxed; that was the hardest part, ministry sources say.

The solution was found through the Hellenic Statistical Authority (ELSTAT), thanks to the latest census, where it was found that there were buildings and permanent residents in some areas outside the system. That allowed for the drafting of zones.

That was also the point when the reluctance of local authorities came to an end; they started cooperating, allowing for the completion of the new zones, before the property surveyors started recommending rates for those areas.

In some cases the delays by the local authorities were the result of bureaucracy in addition to the apparent indifference of municipalities.

The same sources note that, in the past, local committees consisting of officials from the local authorities, the head of the tax office and private sector experts were responsible for drafting the zones and proposing rates, but in many cases they did nothing.