Real estate bracing for rebound and shifts

Net foreign direct investments in the Greek real estate market recorded a reduction of 7.3% in the first quarter of this year compared to the same period in 2020, according to the monetary policy report of the Bank of Greece, tabled on Monday in Parliament. Property FDI amounted to 214 million euros, down from €230.7 million in January-March last year.

Note that for the whole of 2020, foreign direct investments in local realty amounted to just €875 million, compared to €1.45 billion throughout 2019. However, last year’s performance as well as that of January-March 2021 are considered particularly satisfactory if one considers also the impact of the coronavirus and the strict measures applying since March 2020.

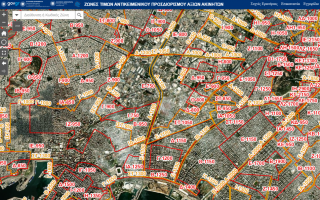

In its report the central bank refers to significant changes in the property market, as the new infrastructure projects such as Line 4 of the Athens metro and the Elliniko development are going to overhaul the capital’s realty market. The report specifically argues that “the changes in needs and mentality will likely lead to a shift of demand in terms of location and quality, while scheduled projects for development and infrastructure of great significance are expected to further strengthen the trend toward the shifts and the emergence of new markets of interest.”

Among those new markets, the report notes, are the capital’s southern suburbs and generally the Attica seafront, as the investment at the former Athens airport plot at Elliniko is certain to generate strong demand for residences, both within and outside the limits of the plot to be developed.

Likewise, the connection of the most densely inhabited districts of Athens with the metro, such as Kypseli, Exarchia, Galatsi and Gyzi, among others, are expected to offer a boost to those local markets too. On the other hand the switch to teleworking also signals the need to purchase or rent larger houses or apartments, with adequate telecommunication connections. These trends are expected to dominate the property market in the coming years.

The Bank of Greece analysis makes special reference to the bureaucracy related to real estate: It notes that “for the optimum rate of the property market’s recovery to be secured, special care ought to be given to the simplification of the procedure for the transfer of real estate assets.”