Little use of cards in services

The value of debit and credit cards transactions by Greeks last year reached 49.6 billion euros, accounting for approximately 38% of private consumption. This percentage was strengthened from the restrictive measures put in place during the pandemic that over the last three years have made plastic money transactions soar, contributing to the convergence with the European average in terms of the card use ratio.

However, as the Foundation for Economic and Industrial Research (IOBE) notes in the study titled “Electronic Payments in Greece during the Pandemic,” the level of card usage in relation to private consumption in Greece remains the 18th lowest among the 27 European Union members, as the card use remains relatively low mainly as services.

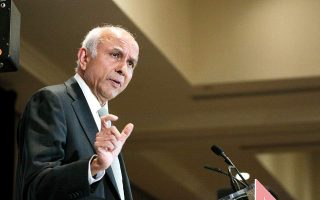

Presenting the findings of the study, IOBE General Director Nikos Vettas associated the need for greater dissemination of electronic payments with the urge to limit tax evasion in specific professional categories. Vettas noted that after approximately seven years (from the implementation of the first restrictive measures, i.e. the 2015 capital controls) of a significant increase in electronic transactions, the measures or incentives that should be given should be targeted where the biggest problem of tax evasion is found.

“The use of electronic means has increased, but has not covered all professions and its spread is found in the products market and less in services,” observed Vettas, noting that the spread of e-payments has a significantly positive effect on tax revenues, so the higher use of electronic payments can improve the poor performance in the “VAT gap” that Greece shows, one of the highest rates in the EU.

The head of IOBE’s Department of International Macroeconomics and Finance, Giorgos Gatopoulos, called for tax incentives, such as immediate cash refunds for cardholders, the connection of deductible expenses of the self-employed using a professional account and electronic payment and the re-promotion of the lottery for targeted professional categories.

At regulatory level, he proposed the implementation of the mandatory acceptance of payments by electronic means to all service providers for B2B and B2C transactions, and the payment of public transfers by electronic means.