Americans splash out on shopping in Greece

Travelers from the United States are responsible for 35% of tax-free purchases, with Israelis coming second, according to recent data

Visitors from the United States are making up for the drop in tourists from China and Russia in terms of the amount of shopping they do while in Greece, and not only are they spending large amounts of money, they are also showing an interest in luxury items.

It is also worth noting that spending by tourists from third countries who are entitled to tax-free purchases is also higher this year than in 2019, with growing interest in jewelry and watches pushing overall spending higher.

The outlook for retail commerce is bright, even though a drop in tourist traffic from China and Russia has seen shops in certain parts of the country and specific categories of retail suffer losses, as Chinese and Russian tourists tended to buy different things to the Americans, Israelis and Arabs.

According to data by Global Blue, a tourism shopping tax refund company, published by Kathimerini, spending on tax-free purchases this September was 70% higher than in 2019. This makes Greece the country with the highest recovery in this area compared with the European Union average and that of other touristic countries in the European south and beyond. In the EU as a whole, tax-free spending rose just 8% against 2019; in Portugal it was 59%, in France 29%, in Italy just 8% and in Spain a mere 3%.

In fact, Greece’s remarkable recovery was evident throughout the nine-month period from January to September 2022, notes Manthos Dimopoulos, managing director of Global Blue Hellas.

Spending on shopping by Americans, the nine-month data show, shot up by 229% compared to 2019

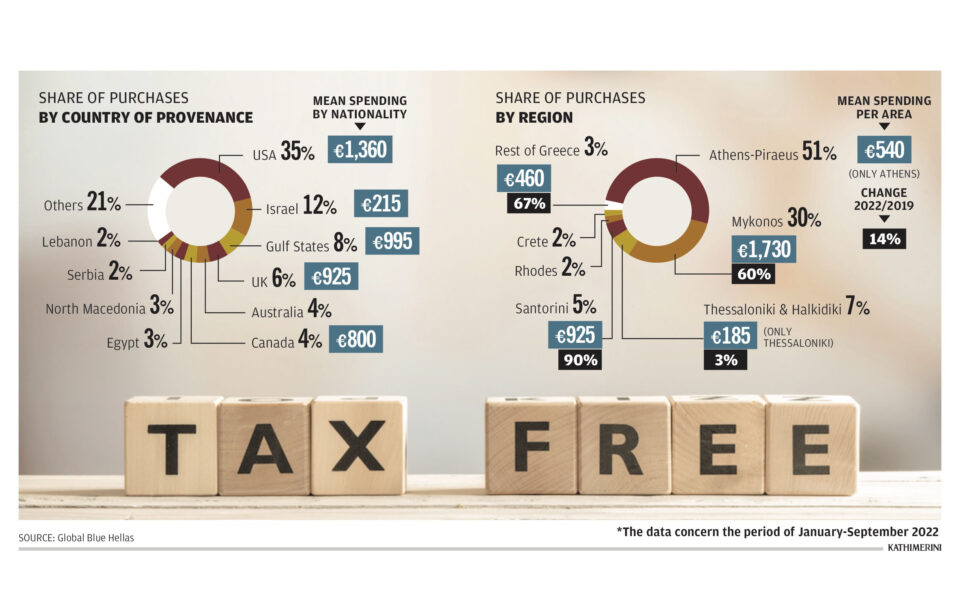

According to the latest figures, the largest share of tax-free purchases in terms of value was made by tourists from the United States (35%), followed by the Israelis (12%). Tourists from the Gulf states accounted for 8% of the market and were lagged by the British (6%), the Australians and the Canadians (4% each), visitors from Egypt and North Macedonia (3% each), Serbs and Lebanese (2% each), while the remaining 21% concerns purchases by other nationalities, outside the EU.

Spending on shopping by Americans, the nine-month data show, shot up by 229% compared to 2019, while average spending on tax-free purchases rose 61% compared with pre-pandemic levels to reach an average of 1,360 euros. Israelis visiting Greece are spending three times as much on tax-free retail purchases compared with 2019, at an average of 215 euros, or 22% above 2019.

The highest average spending after the Americans is by the Arabs (995 euros), the British (925 euros) and the Canadians (800 euros).

In fact, Americans and Arabs are in the category of so-called “elite” travelers, a term used to describe visitors who spent more than 40,000 euros in the past 24 months on tax-free purchases.

Geographical distribution

While Athens may account for half the tax-free purchases made in Greece, average spending is higher in the country’s ultimate “cosmopolitan” destination, Mykonos. Little surprise that major fashion, accessory and jewelry brands are opening stores on the wildly popular Cycladic island.

Therefore, average spending on tax-free shopping came to 540 euros in the year until September in Athens, which accounts for 51% of overall purchases, while on Mykonos, where 30% of purchases were made, the average amount spent was 1,730 euros. Also indicative of the trend is that the equally popular island of Santorini accounted for just 5% of tax-free purchases and saw average spending of 925 euros.

Even though 63% of all these purchases concerned clothing and footwear, Global Blue also noted a rise in interest in jewelry and watches, which reached 30% this year from 20% in 2019. Average spending on jewelry came to 3,700 euros (69% up from 2019), while on clothing and footwear it came to 420 euros (+18%).

With regard to elite travelers in particular, their average spending in Greece between January and September came to 14,000 euros, a rise of 119% compared with 2019. Travelers in this category do most of their shopping in Athens (59%), Mykonos (32%) and Santorini (5%). Another interesting finding was the fact that elite travelers from the UK spent more than others at 25,800 euros on average. They were followed by American elite travelers with 21,500 euros, Israelis with 16,400 euros (a fivefold increase from 2019), travelers from Southeast Asia (excluding China) with 13,800 euros, and those from Arab states with 11,500 euros.

Digital validation

An important development in the tax-free retail landscape has been the introduction – on paper at least – of the ability to digitally validate tax-free purchase receipts. This is something shopping tax refund companies like Global Blue and retailers had been demanding for years, arguing it would significantly speed up refunds and act as an important incentive to bolster the market. Under the decision published in August by Greece’s Independent Authority for Public Revenue, shopping tax refund companies that are active in Greece can develop their own digital validation service with their retail partners. The decision also makes it mandatory to include details concerning transactions (such as the name of the traveler, their passport number, their home address etc) on the myData platform. Dimopoulos, however, notes that the requirement of posting this data within 24 hours of each transaction and that digital validation is going into force on January 1, giving the market little time to prepare, will create problems. The two main risks, according to market players, are that it may encourage tax evasion because tax-free receipts do not require tax details and many retailers will stop selling their products tax-free because they will not have time to comply with the data entry requirement.

“In a tourist country like Greece, this would be a blow to the country’s image and devastating to retail sales. The problem is especially severe for small-scale retailers in popular destinations who do a lot of tax-free sales and won’t be able to keep up,” says Dimopoulos.