Why are rental rates skyrocketing?

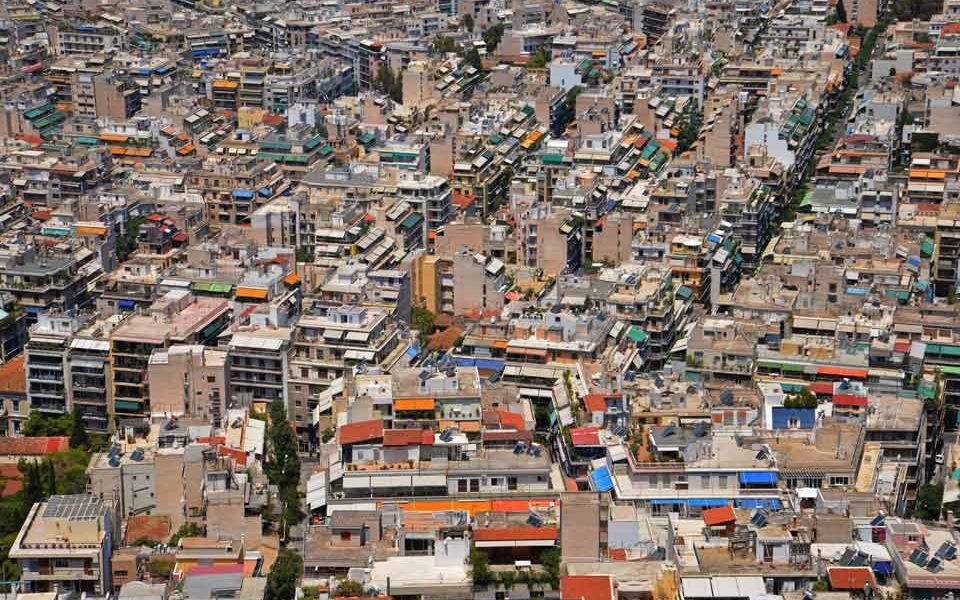

According to the available data, residential rental rates have been rising much faster than salaries in recent years, making some neighborhoods, and especially in central Athens, too expensive for young house-hunters. Why is this happening? And what can be done about it?

Oddly enough, skyrocketing rents are a sign of both a positive and a negative development. Increased demand for housing is an indication that the city has become more attractive, as the rule is that residential property prices and rents are stagnant when the local economy is struggling. In contrast, a city that is fast turning into a magnet for younger residents tends to result in increased pressure on the property market.

The crucial question is whether supply will rise sufficiently to absorb the increase in demand. If it does, new residents (and those who already live there) will be in a position to buy or rent at a manageable price. If it doesn’t, sale and rental rates will just keep rising. In this latter instance, expensive rents will start to eat away at the city’s momentum, restricting its growth.

This is by no means a Greek phenomenon only. In Milan, an oasis of prosperity in a quagmired economy, rental rates are through the roof – and the result is that hospitals can’t find doctors, schools are running low on teachers and businesses are having trouble recruiting staff.

What is preventing an increase in the supply of housing, which would offset the pressure on rental rates? Basically the fact that construction focused on tourism accommodation after the bubble that led to last decade’s crisis. Non-serviced loans and the recent interest rate hike, meanwhile, put a freeze on mortgages.

In addition to this, by adapting the Golden Visa scheme as it did, Greece did not just sell the ability to become a European citizen for an embarrassingly low price (while at the same time depriving thousands of hard-working migrants who have put down roots here of the same privilege with all sorts of shenanigans), it also managed to score a stunning own goal against any housing policy. The first move made by many foreign “investors” taking advantage of the visa scheme by snapping up cheap properties in central Athens districts like Pangrati or Koukaki was to turn entire apartment blocks into short-term rental units, thus depriving the city’s residents – and potential tenants – of these properties. In this way, foreign investments in residential property – which the country’s economic staff likes to tout – increased the pressure on rental rates instead of reducing it.

So how can the availability of homes for rent increase?

Social housing schemes have been very effective in other parts of the world and could accomplish a lot more with the support of the EU’s New European Bauhaus initiative, but the very notion has a very poor reputation in this country (the writer grew up in so-called “workers’ housing”). Perhaps a new generation of architects and city planners could design affordable housing, homes they would be happy to live in themselves, and an enlightened government would give them the economic and political support they need to do so – perhaps, at some point in the future.

Until that day comes, the unfettered expansion of short-term rental units needs to be stopped. Other European countries have set limits on the number of residences a single owner can rent through the relevant platforms (to two, for example) and the number of days a year that their properties can be exploited commercially (to, say, 60). They have also compelled the platform to provide them with the information needed to ensure that landlords are complying with these regulations – and with their tax obligations.

In the meantime, there is an abundance of empty homes in Greece’s cities. The “Renovate – Rent” subsidy program is a clever attempt to convince (and pressure) landlords to spruce up their properties and put them up for rent. Now we just have to hope that it works.

Manos Matsaganis is a professor of public finance at the Polytechnic University of Milan, and head of the Greek and European Economy Observatory at the Hellenic Foundation for European and Foreign Policy (ELIAMEP).